Investment

For many aspiring investors, the question of where to begin looms large. From stocks to bonds, mutual funds, ETFs, or the burgeoning field of alternatives, it’s no surprise that many people feel overwhelmed or paralyzed by the options. The good news is that if you have $500,000 or more of investable assets, you are to hire a professional to guide you down the proper path, depending on your objectives. All investments offer some potential for returns, some greater than others, and there are varying risk factors or possible tax implications to be aware of. Even if you consider yourself financially savvy, having a trusted financial partner can pay big dividends. This is where a fee-only financial advisor can step in. By offering a sense of greater confidence and bringing more focus to your plan, they should increase the probability of success. Managing your wealth is more than watching investments grow. It’s about aligning various financial strategies with your current circumstances and future goals, ensuring that your wealth serves a broader purpose rather than just numbers on a screen or statement. Your goals may vary or sometimes seem to be competing—whether that’s funding your retirement, supporting causes you care about, or building your family’s financial future through buying a home or setting aside money for a loved one’s education. The challenge is losing sight of the bigger picture, which is easy without a structured financial plan. Breakwater Capital offers holistic wealth management services for successful individuals and their families. Our experienced team of CFPs® provides personalized strategies to help you build, preserve, and distribute your wealth. Focusing on your unique goals, we guide you through the complexities of financial decisions, ensuring thoughtful and knowledgeable support at every step. In this blog, we’ll explore how fiduciary, fee-only financial planning can meaningfully impact your wealth management experience.

If we have learned anything these past few years, it’s that public equity and bond markets can be extremely volatile and with interest rates being so low for so long, it pushed many people into more risk on assets making their experience one heck of a roller coaster recently. With all of the turmoil in the public market space, “alternative investments” have been marketed more heavily now than ever. This can be a long journey to embark on but we are up for the task. In this initial piece we will start broad brush strokes and continue to deliver content that delves into each category to finely fill in the pieces. Alternative Investments or Alts (industry lingo) refers to a broad category of non-traditional financial assets that are distinct from traditional investments like stocks and bonds that are priced out every day. Sometimes, these types of investments have low correlation with traditional markets and may provide diversification benefits to a portfolio. Some of the most common types of alternative investments include: Private Equity – Investments in private companies or funds that invest in private companies. Investors can acquire ownership stakes in private businesses. Hedge Funds – Investment funds that employ various strategies to generate returns for their investors. Hedge Funds often use leverage and can invest in a wider array of assets, including stocks, bonds, derivatives, and currencies. Real Estate – Direct ownership of physical properties or investments in real estate investment trusts (REITs), which are companies that own, operate, or financial income-generating real estate. Commodities – Investments in physical goods like gold, silver, oil, or agricultural products. Investors can gain exposure through commodity futures contracts or commodity-focused funds. Venture Capital – Investments in early-stage companies with high growth potential. Venture capitalists provide funding to startups in exchange for equity. Private Debt – Investments in non-public debt securities, including loans to private companies. This can include direct lending or investing in private debt funds. Infrastructure Investments – Investments in physical infrastructure projects such as airports, toll roads, or utilities. Art and collectibles – Investing in valuable art, antiques or other collectibles. Cryptocurrencies – Digital or virtual currencies that use cryptography for security. Bitcoin and Ethereum are popular examples of such currencies. Derivatives – Financial contracts whose value is derived from an underlying asset, index, or rate. The most commonly known examples are options and futures contracts. They require a higher level of expertise and due diligence on the part of the investors. Alternatives can be generally considered riskier and less liquid than traditional investments. Sometimes they can provide overall portfolio diversification and the potential for higher returns, but they also come with increased complexity and volatility. Vetted due diligence and research are an absolute necessity when it comes to picking the right offerings for your portfolio. As with any investment investors need to assess their risk tolerance and goals before considering adding anything to their portfolio. The views expressed represent the opinions of Breakwater Capital Group as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed. Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.

The “American Dream” has been defined in a myriad of ways, but one of the more common elements revolves around the concept of home ownership. We’ll try to distill the question of whether to buy or rent, down into a handful of key factors and while we realize that everyone’s circumstances are a bit unique, there are some important elements that apply to anyone making this decision. It is also worth looking at the current market through a historical context, so we have added some additional detail below. We acknowledge for many given the affordability challenges that exist today there may be no choice but to rent for now, but that may very well turn out to be a blessing versus a curse with home affordability at historically low levels. For someone that spent much of his adult life renting, I can say that decision worked well in that I avoided buying in during the housing boom that would turn into an epic bust at the turn of the century. Had I followed the conventional wisdom at the time, I would have drastically overpaid for a place that I would have resented a few years later. In addition to avoiding that calamity, the excess savings each month allowed me to set aside funds, much of which found its way into the market which has not been a bad thing for the last 15 years. It also meant that I could maintain a degree of flexibility with where I lived which had some qualitative positives. For those of you adamant that homeownership is the best path, all is not lost. The housing market has cycles and it stands to reason in the future there may be better times ahead. Patience is a virtue as they say… Let’s dive in:

Japan is back… Where were you in 1989? It is a welcome sight witnessing the Japanese stock market get back to levels it last touched when I was wearing tube socks and playing Nintendo. In the first quarter the TOPIX was up 10.05% matching the S&P 500 torrid start to the year. But it’s not just in the capital markets that are buzzing. You could stay up late watching Bloomberg Asia during market hours but since that should be time to wind down, you won’t be disappointed taking in two of the best series on television right now… Max’s Tokyo Vice and Shogun on FX. The world’s third largest economy as measured by GDP deserves some love. Between pop culture and higher stock prices it’s a new dawn in The Land of the Rising Sun.We are in the midst of March Madness, the pinnacle of excitement in “amateur sports” it’s hard to replicate something so immersive and exciting, but I worry the combination of the NIL and sports betting has irreparably damaged the purity of the tournament. We are all aware by now that the pandemic ushered in new era of gamification and gambling providing a much-needed distraction and some excitement in those dark days of lockdowns and masks. When it comes to wagering it’s common knowledge the house always wins. All you need to do is look at the gambling stocks which have been on a tear as they quietly pick your pockets. I have my thoughts about legalizing drugs and making gambling more accessible, but rather than pontificate, I have a more compelling suggestion. On any given day, the stock market chances for an increase is no greater than a coin toss. Alas if you buy a stock or fund you get to play that same wager over 240 times a year and rather than the “house” ending up ahead in the long run you likely have a lot more to show for it.The death of Nobel prizing winning psychologist Danny Kahneman last month had me reflecting on a true intellectual giant’s contributions to the world of behavioral finance and its value to the everyday investor. Even for someone who has spent more than two decades honing my craft, I am often surprised/amused at the tricks our minds play on us when it comes to investing. Dr. Kahneman’s seminal work Thinking, Fast & Slow is a true masterpiece, but many struggle to make their way through it. Michael Lewis’s 2016 Undoing Project is a wonderful tribute to Danny and his best friend Amos Tversky, and is a really approachable read for those unwilling to commit to the intellectual density of T, F & S. Any investor would be well served to learn about loss aversion recency bias or the endowment effect to name just a few of those blasted biases. Just when you thought people were coming to their senses and the crypto bust of 2021-2022 rid us of the daily digital data dump, here we are again with the biggest grift in modern times. I have to give it to them, despite lacking a compelling use case the Bitcoin believers have talked their way into one of the most epic executions of the greater fool theory in the history of man. Happy to have Wall Street get in on the rouse, the SEC and the sponsors of the various Bitcoin ETFs should be ashamed of themselves. Making it easier for people to lose their hard earned money is not why we are in this business and anything to “legitimize” an endeavor that has funded terrorism, human trafficking and the drug trade all for some basis points is an embarrassment. While we are on the topic of dereliction of duty, has anyone spoken with a family trying to navigate the FAFSA process this year? It’s bad enough that it costs $90,000 for a year at a prestigious liberal arts college, but to think we are making it more difficult to apply for and receive aid. You wonder why the younger generations are fed up and both sentiment levels and the government’s approval rating is at historically low levels despite a stock market at all-time highs and an unemployment rate under 4%. Applications for aid are down 57%, you read that right while the costs of college skyrocket. And those that applied were working with incomplete data. I can’t make this stuff up. We are supposed to be taking care of those in need, but we are more likely to see students take on more debt. If there was ever a better reason to start plowing money into the 529 plans now then let me know. It’s not to say we shouldn’t take the aid available to us, but perhaps it’s best to be in a position where we don’t need to count on it. George Carlin may have been thinking about another dirty word when he heard someone mutter the word inflation. It’s surely making the current administration cringe with the election less than 7 months away. While the rate of price changes have dropped markedly from their peaks in the summer of 2022, recent data suggests the victory lap for Fed which kicked off in October coinciding with this strong rally, may have been a bit premature. Coming into the year the market was pricing in 6 or even 7 rate cuts but a combination of better labor data and price stickiness has reduced the probability of aggressive easing getting under way. Just this week, on Monday, the ISM Manufacturing Survey showed we entered expansion territory in March for the first time since the Fall of 2022 and now the odds suggest just two cuts may be in the cards for 2024. It’s becoming increasingly more evident that we are in a period of fiscal dominance, I am not sure that monetary policy is having as much of an effect outside of residential and commercial real estate. The former is holding up fine in the face of limited inventories while the latter is holding on for dear life; they stare down the barrel of a gun in the form of refinancing. Always good to zoom out a little. I am not sure we will see those prices come down without a deep recession, but before we do too much hand wringing it’s important to put things into the proper perspective. For the last 30 years, dating back to 1994, CPI has average just below 2.50% including the recent the elevated inflation, that’s less than half the inflation for the 30 years from 1966 through 1995 where prices grew at a clip of over 5.4%. Magnificent 7, 6, 5 4, 3 , 2, 1… Aside from Meta and Nvidia the latter of which has somehow managed to add an 80% return on top of a truly breathtaking 2023 performance, we have seen quite the dispersion in the returns and what appears to be a case of returning from orbit for high flying Apple and Tesla. With the group trading at a forward P/E ratio of 31 times there is no room for error as they trade at 50% premium to the S&P itself over which they have a great influence given their size. What is even more amazing is that they trade at a 100% premium to the equal weight index. Something has to give, is it that Amazon, Microsoft, Meta and Alphabet starts to resent buying GPUs from Nvidia with 80% gross margins and they start in house fabrication much like Apple did with ditching Intel in 2020. Rent seeking behavior is usually short lived as competitors look to take share as well. Or perhaps it’s all that enterprise spending that doesn’t yield the earnings growth forcing multiples to contract. Much like the upcoming NFL draft there rarely is a can’t miss story out there. Much like “retired” Bill Belichick did at the helm of the New England Patriots for 20+ years, perhaps trading down and having more picks allows you to build a better roster versus needing everything to go right with your one great idea. Diversification and identifying mispricing is a consistent path to wealth even if it takes you a little longer to get there. Common prosperity or conciliatory China? Polishing off the old playbook and rebranding communism by using some more gentle words like common and prosperity doesn’t mean your people have to like it. History suggests that there is nothing common about prosperity when the state dictates distribution of resources as was the case for the 30 years under Chairman Mao until Deng Xiaoping ushered in market based reforms in the late 1970s and early 1980s. Clearly Xi Jinping’s admiration of Mao Zedong’s emphasizes his cult of personability and despotic tendencies while minimizing the fact his policies resulted in the deaths of millions of Chinese whether by famine or the Cultural Revolution. But the Chinese have had their taste of capitalism it appears they like what they experienced. While the property problem persists, efforts to cool tensions between the US and Chinese relations along with more aggressive and targeted stimulus may break the years’ long malaise. The last pre-pandemic slowdown in China required about 2 years to run its course and then set up a period of synchronized global growth from 2016-2019 a similar recovery would be welcome as trade may provide further disinflationary pressures as they compete with Mexico and India for labor and any increase in consumption is bound to help US multinationals grow earnings after the US consumer eventually slows down. We are not ready to pivot away from our view China is practically un- investible but this is modestly constructive and worth monitoring. Virtuous cycles of asset allocation based investing. Whether the calendar dictates adjusting your investment mix or there is more discipline based on drift and data, the fact we have spent 30 of the last 40 years in one heck of a bull market has meant that there has been an unquenchable demand for fixed income. At one point the bond market in the US dwarfed the stock market but stocks have caught up where both pools of capital valued at about $51TT. Globally the bond market is a bit bigger than the equity markets, $133TT to $110TT. Rates have been coming down since the early 1980s only to have increased a bit in the middle of the 2000s and again most recently. Higher rates should attract more buyers, yet $6TT is parked in money market funds. The average bond buyer has become much more price (yield) insensitive, buying bonds in something resembling rote behavior. If the market continues to go up and likely at a rate of change that exceeds the bond market, and it should given the uncertainty associated with owning stocks and the natural inflationary forces that drive asset prices higher, then we should more often than not have a bid putting something of a lid on yields and not needing to implement a Japan style yield curve control. Mark Twain’s famous quip about his death being an exaggeration seems fitting for all those folks. Please join us April 18th for our Quarterly Market Review and Outlook. Register Now Sources: Baron’s WSJ, BLS, ISMForbes, JP Morgan Asset Management Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.

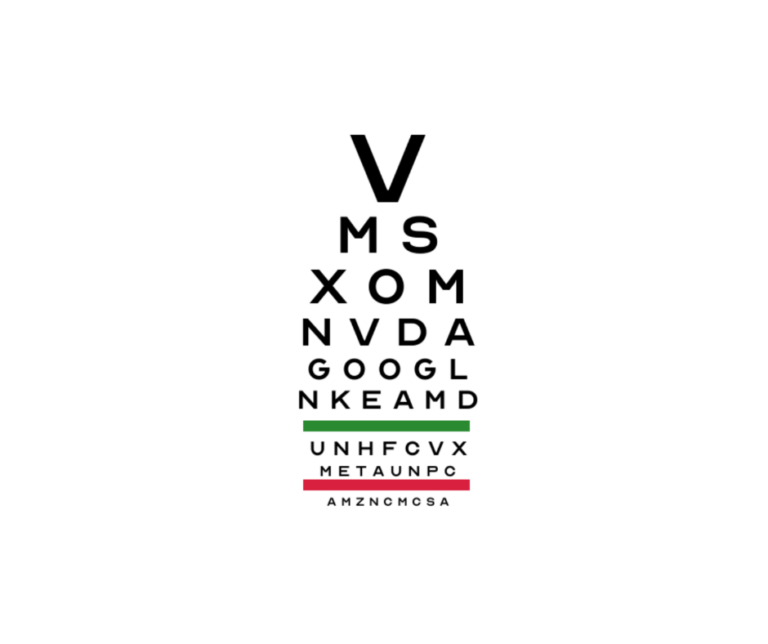

Getting pretty technical here aren’t we… How using charts can improve your investing and worsen your eyesight. At one time or another we have all found ourselves on a quest for the next great investment idea or to identify the next bubble before it bursts. For some of us it’s a lifetime endeavor while for others it’s a fleeting moment of excitement fueled by someone else’s success or failure. It’s safe to say that much of Wall Street is focused on the less glamorous field of fundamental analysis where valuing companies, industries or sectors is based on using traditional metrics like free cash flow or price to book ratios among countless others. This is a rigorous and helpful process but requires the use of assumptions sometimes on a single variable, but more often than not assumptions with multiple variables. This makes trying to estimate the earnings of a company 2 quarters out difficult, let alone 2 years or 10 which seems next to impossible, frankly. That is supposed to be one of the preferred methods to arrive at a price to pay for a security. This isn’t to suggest this effort is futile, but to acknowledge its limitations therefore incorporating additional information into one’s investment process would seem to make sense. Schumpeter described the concept of creative destruction, which posits that the state of constant change is filled with innovation and destruction. We have all borne witness to this over the course of our lifetimes whether we are talking about iPhones or Uber. Companies disrupting the incumbents or creating an entirely new market from scratch makes capitalism so dynamic and exciting, but it also makes using past economic models challenging at best or worse, outright obsolete. I don’t foresee that changing any time soon so if we are trying to identify something constant in all this it may be as easy as looking in the mirror. After 300,000 years on the planet, humans have more or less wired themselves through the evolutionary process and that “hard coding” can be really valuable to understand. Everyone is familiar with the “fight or flight” concept, which is about survival in its simplest form. Safe to assume flight is the better bet most of the time when it comes to physical confrontation but that same reaction function can wreak havoc on our portfolios triggering ourselves to sell out when the market is troughing. The same can be said about herd mentality, where behavior becomes something akin to a mania and totally dispels the idea of the wisdom of crowds. I am essentially talking about behavioral finance, something we have been writing about on occasion for the last couple years and following for the last couple of decades. Assuming we can (or can’t) control our inner impulses, that will provide us with an edge, especially since it’s apparent that most people are incapable of that level of discipline. How best to exploit those human inefficiencies you ask? Sometimes it’s as simple as picking up anecdotal evidence like the stock tips from the shoeshine boys of yesteryear, but not everything is as obvious an outlier as Bored Apes NFTs and Meme stocks or subprime housing bubbles. Incorporating technical analysis is a tool that may be able to help. So what is technical analysis really? It is the use of price and volume data to inform one’s investment decision making process. Perhaps better said, fundamentals tell you the what, while technical tell you when and how far. With the troves of data out there, patterns and trends often emerge that are a reflection of investor’s sentiment and expectations and identifying them early on may allow you to augment your returns or cut your risk exposure. Here are a few indicators that traders and investors look for when employing technical strategies: Price Trends confirmed by trading volume: Price movements may be random or noise, unless they are accompanied by surges in activity at which time they like represent a signal Momentum: Much like Newton’s famous first law of motion which states an object in motion, stays in motion the same has often applied to stocks. The momentum effect or factor is a bit controversial in that it seems to suggest chasing returns but academic research has found it to be a helpful tool when paired with other factors (size, value, quality etc…) Moving Averages: Looking at price over varying time series reveal inflection points for markets, common measurements are the 50, 90 and 200 day moving averages. When prices move above or below the moving averages it suggests the stock may have broken through a resistance point and are headed higher or lower as a result. There are countless techniques dedicated to this field of investing, many of which are more detailed or complex and outside the scope of this piece. We’ll admit there are surely some short term elements to this approach but incorporating this information into your thought process means you are adding an extra layer to what is hopefully a sound long term strategy. We surely think it’s valuable at Breakwater even if it makes our eyes blurry by the end of the day.

You’ve likely heard the term Behavioral Finance over the last few years, whether it is for a Nobel Laureate’s awarding winning research, a webinar we hosted with Daniel Crosby Ph.D., or a topical news article in the Wall Street Journal. The burgeoning field and its efforts to better harness our inner impulses have moved from the theoretical work in academia to center stage today. Whether it’s AI looking to identify those human clues in the data or your advisor trying to talk you off that ledge, if we better understand ourselves and our tendencies we are destined to be more successful investors. Much like the question about the chicken and the egg, our actions and impulses have as much influence on the market as markets themselves do on our moods and decision making. An easy analogue is the rise of the influencer economy where platforms like TikTok, Reddit (meme mania) or a celebrity promoting a brand (Dunkin Donut’s anyone) or has captured the imagination of the general public and often time the viral effects that a large and growing network can manifest. With the market, I can think of no better example than Tesla and their mercurial genius founder. It’s hard to argue that the company has not created a truly differentiated driving experience, which has spilled over to impact decisions at all of the major automobile manufacturers’ mainstream. We know of the recent problems with EVs but it’s irrefutable that tectonic shift has occurred. With TLSA, back in 2010 the stock was priced at $17 at IPO and opened at $19, 13+ years later after undergoing two splits (5:1 in 2020 and then 3:1 in 2022). An original $5000 is now worth $882K based on the stock trading at $200/share. How much of their success has been about the stock price itself and how much of the stock price is about the product they make will be debated for many years ahead. Let’s get into the specifics of this field of psychology…

“It takes as much energy to wish as it does to plan.” – Eleanor Roosevelt. Eleanor Roosevelt was as wise as they come. As Eleanor Roosevelt implied, spending time on planning is a MUCH better use of time than wishing. There are many facets to a financial plan that should be fully customized given a person’s situation, below are four of the major areas to address. Each of these areas help to protect a person’s wealth, wishes and legacy.