Technical Analysis: Uncovering Market Insights

Getting pretty technical here aren’t we…

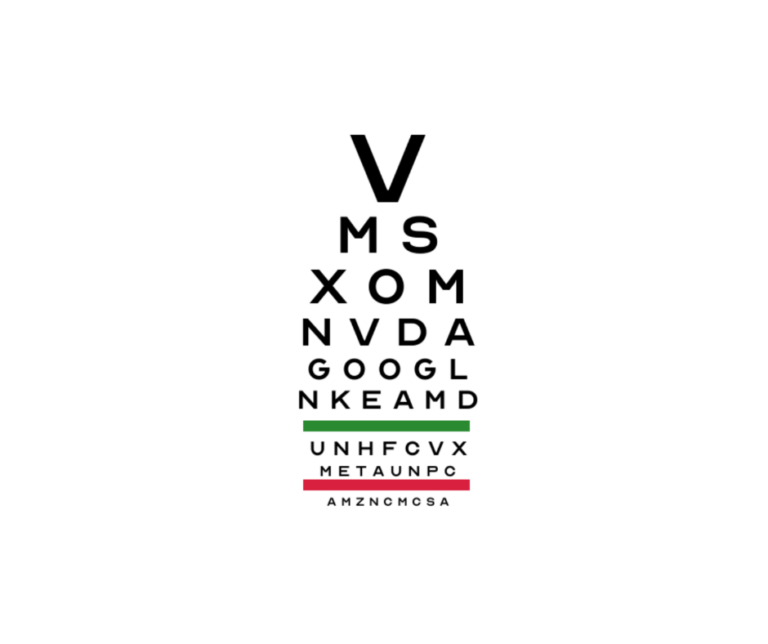

How using charts can improve your investing and worsen your eyesight.

At one time or another we have all found ourselves on a quest for the next great investment idea or to identify the next bubble before it bursts. For some of us it’s a lifetime endeavor while for others it’s a fleeting moment of excitement fueled by someone else’s success or failure. It’s safe to say that much of Wall Street is focused on the less glamorous field of fundamental analysis where valuing companies, industries or sectors is based on using traditional metrics like free cash flow or price to book ratios among countless others. This is a rigorous and helpful process but requires the use of assumptions sometimes on a single variable, but more often than not assumptions with multiple variables. This makes trying to estimate the earnings of a company 2 quarters out difficult, let alone 2 years or 10 which seems next to impossible, frankly. That is supposed to be one of the preferred methods to arrive at a price to pay for a security. This isn’t to suggest this effort is futile, but to acknowledge its limitations therefore incorporating additional information into one’s investment process would seem to make sense.

Schumpeter described the concept of creative destruction, which posits that the state of constant change is filled with innovation and destruction. We have all borne witness to this over the course of our lifetimes whether we are talking about iPhones or Uber. Companies disrupting the incumbents or creating an entirely new market from scratch makes capitalism so dynamic and exciting, but it also makes using past economic models challenging at best or worse, outright obsolete. I don’t foresee that changing any time soon so if we are trying to identify something constant in all this it may be as easy as looking in the mirror.

After 300,000 years on the planet, humans have more or less wired themselves through the evolutionary process and that “hard coding” can be really valuable to understand. Everyone is familiar with the “fight or flight” concept, which is about survival in its simplest form. Safe to assume flight is the better bet most of the time when it comes to physical confrontation but that same reaction function can wreak havoc on our portfolios triggering ourselves to sell out when the market is troughing. The same can be said about herd mentality, where behavior becomes something akin to a mania and totally dispels the idea of the wisdom of crowds. I am essentially talking about behavioral finance, something we have been writing about on occasion for the last couple years and following for the last couple of decades.

Assuming we can (or can’t) control our inner impulses, that will provide us with an edge, especially since it’s apparent that most people are incapable of that level of discipline. How best to exploit those human inefficiencies you ask? Sometimes it’s as simple as picking up anecdotal evidence like the stock tips from the shoeshine boys of yesteryear, but not everything is as obvious an outlier as Bored Apes NFTs and Meme stocks or subprime housing bubbles. Incorporating technical analysis is a tool that may be able to help.

So what is technical analysis really? It is the use of price and volume data to inform one’s investment decision making process. Perhaps better said, fundamentals tell you the what, while technical tell you when and how far. With the troves of data out there, patterns and trends often emerge that are a reflection of investor’s sentiment and expectations and identifying them early on may allow you to augment your returns or cut your risk exposure. Here are a few indicators that traders and investors look for when employing technical strategies:

Price Trends confirmed by trading volume: Price movements may be random or noise, unless they are accompanied by surges in activity at which time they like represent a signal

Momentum: Much like Newton’s famous first law of motion which states an object in motion, stays in motion the same has often applied to stocks. The momentum effect or factor is a bit controversial in that it seems to suggest chasing returns but academic research has found it to be a helpful tool when paired with other factors (size, value, quality etc…)

Moving Averages: Looking at price over varying time series reveal inflection points for markets, common measurements are the 50, 90 and 200 day moving averages. When prices move above or below the moving averages it suggests the stock may have broken through a resistance point and are headed higher or lower as a result.

There are countless techniques dedicated to this field of investing, many of which are more detailed or complex and outside the scope of this piece. We’ll admit there are surely some short term elements to this approach but incorporating this information into your thought process means you are adding an extra layer to what is hopefully a sound long term strategy. We surely think it’s valuable at Breakwater even if it makes our eyes blurry by the end of the day.

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.