What to be thinking about with the Fed on the brink of cutting rates…

We have all heard the adage… “Don’t fight the Fed.” That was sage advice back in 2022 as the Fed embarked on the most aggressive tightening cycle dating back 40 years. That year both stocks and bonds withered, ending the year down by double digits, you would have to go back to 1941 the last time both asset classes showed losses for the year when you use the 10-year Treasury as a proxy for the bond market. Now with the pendulum shifting from tightening monetary policy to “easier money” everyone is trying to understand what that means for the economy and their portfolio in the months and years ahead. Lately the narrative has shifted a bit, there is a growing chorus that believes that monetary policy and by that we are really referring to the Fed’s setting of overnight interest rates in an economy dominated by bits and bites versus the more tangible attributes of yesteryear has less impact today. Or perhaps, it’s those long and variable lags Milton Friedman was referring to as higher rates are still making their way through the economy. If that is the case it stands to reason that even if liftoff is September it may take time for lower rates to exert their influence. In this piece we are going to explore rates from a few different perspectives. One thing to make clear, we are not market timers and market rates are a byproduct of not just Fed policy, but numerous other factors, like growth and inflation expectations, fiscal policy, the state of geopolitics etc… We can use the past as a prologue have been taking and will continue to take some steps on behalf of our clients whose assets we are managing for important life goals.

Equity Investing

U.S. Stocks

When the Federal Reserve cuts interest rates, it typically has a positive impact on US stock markets. If that is to play out again now, making sure that your portfolio is allocated properly when the Fed is inclined to cut rates is critically important. Here are some key points on how and why this occurs:

- Lower Borrowing Costs: Reduced interest rates make borrowing cheaper for companies and consumers. Newly lowered rates can lead to increased spending and investment, which often boosts corporate profits and, consequently, stock prices.

- Increased Consumer Spending: With lower interest rates, consumers may be more prone to take out loans for big-ticket items like houses and cars. Increased consumer spending can drive higher sales and earnings for companies, positively affecting their stock prices.

- Improved Corporate Earnings: Companies with existing debt benefit from lower interest payments, which can improve their profitability. This can lead to higher stock valuations.

- Shift from Bonds to Stocks: Lower interest rates typically lead to lower yields on bonds. Investors seeking higher returns might move their investments from bonds to stocks, positively impacting stock prices.

- Economic Confidence: A rate cut is often seen as a proactive move by the Fed in support of the economy. This can boost investor confidence, leading to increased buying activity in the stock market.

- Sector-Specific Impacts: Certain sectors, such as technology and consumer discretionary, often benefit more from lower interest rates due to their reliance on borrowing for growth and consumer spending patterns. Sectors that are highly capital intensive or with significant fixed costs stand to benefit more than asset light business historically. Financials tend to see their net interest margins or “NIM” shrink as rates come down, though a protracted period with an inverted yield curve may be less make lower rates less of a headwind if the curve returns to its normal sloping relationship where longer rates are higher than shorter rates. Manufacturers could see a benefit if lower rates mean a lower dollar making their goods more competitive when it comes to global trade.

Small Cap Stocks

With the incredible rise of the Magnificent 7 stocks, small cap stocks have been overlooked. A change in outlook by the Fed may create an environment for small cap stocks to continue to climb.

- Lower Borrowing Costs: Small-cap companies, which often have higher debt ratios than larger companies, benefit considerably from reduced interest expenses when rates are cut. Lower borrowing costs can improve their profitability and support expansion efforts whether it be adding to their workforce or expanding research & development.

- Growth Potential: Small-cap stocks are typically seen as growth-oriented investments. Afterall, companies that are now among the largest companies in the world like Amazon, Apple, Nvidia and Microsoft all started as small caps! Lower interest rates can spur economic activity, benefiting smaller companies that may be more agile and able to capitalize on new opportunities.

- Increased Risk Appetite: Rate cuts can increase investor confidence and risk appetite. Investors may be more willing to invest in higher-risk, higher-reward small-cap stocks during periods of lower interest rates.

- Access to Capital: Lower interest rates can make it easier and cheaper for small companies to raise capital, whether through loans or equity offerings. This can help them invest in growth initiatives, leading to higher stock prices.

Overseas Equities

- Yield differentials may narrow: Foreign capital has been lured into US assets for many years dating back to the European Debt Crisis in the early 2010s. If US interest rates look less attractive by comparison than foreign capital may be onshored and find its way into local stock markets.

- A weaker dollar may ease inflation and lower borrowing costs: A more common phenomenon in the emerging markets where consumption of commodities represent larger percentages of overall spending may allow for capital to be directed more productively and as foreign companies and countries often offer dollar bonds to institutional investors to hedge the currency risk the cost of that interest could drop if the local currency strengthens vs. the dollar.

- Foreign assets may offer a store of value: Should the dollar weaken, it stands to reason that it’s losing ground to some other currency; that relationship can serve as a hedge to offset the diminishing purchasing power of local assets.

After a long run with a stronger dollar, if there is a secular shift underway that will unfold over the years ahead, having some additional exposure aboard would be valuable from both a risk and return perspective. The combination of more attractive valuations should provide a little extra incentive to increase the ex-US holdings in the portfolio, even if it is just at the margins. One thing to keep in mind, in the past monetary policy has generally been pretty well coordinated, but if that is to change in the years ahead it will be that much more important to have some professional oversight to help navigate what could result in a little more short-term volatility.

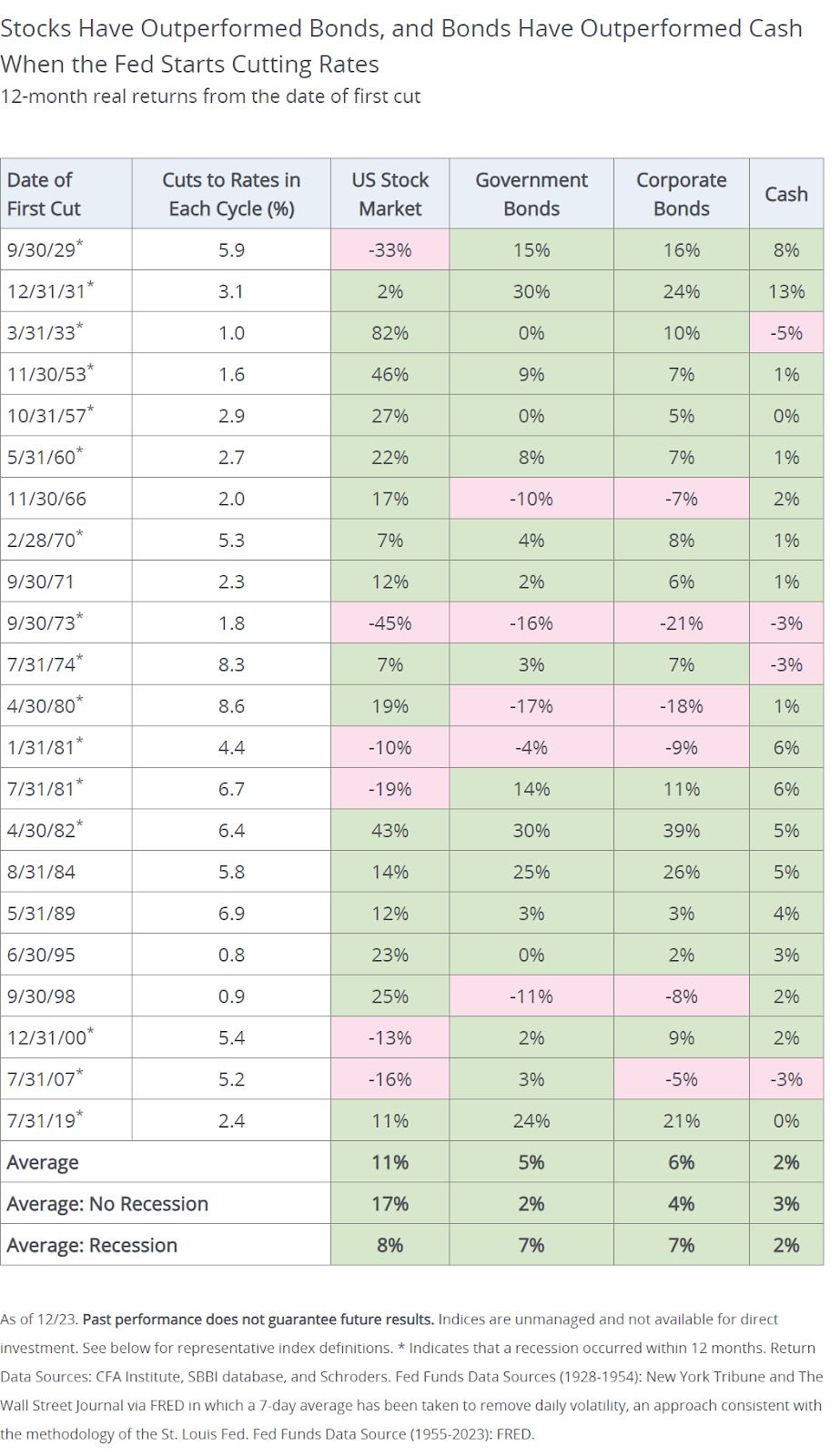

Stocks historically have fared well when the easing cycle begins, though it’s not always the case, especially if the easing is in response to a shock to the economy or deteriorating fundamentals. The latter does not appear to be the case today though there are signs of continued cooling in the labor markets where with the former, a shock, well, that’s tough to predict, after all it wouldn’t be considered a shock. It’s those known unknowns or unknown unknowns, that get you in trouble to quote the late Donald Rumsfeld.

Fixed Income Investing

When the Federal Reserve starts to alter its posture regarding rates, it creates an opportunity to make adjustments to the fixed income portion of your portfolio. Investment-Grade Corporate Bonds have traditionally outperformed short-term bonds when the Fed ends a cycle where it was increasing rates. Here are a few reasons why corporate bonds might make sense.

- Lower Yield on New Bonds: When interest rates fall, newly issued bonds typically offer lower yields. Existing investment-grade corporate bonds, which have higher yields, become more attractive in comparison, driving up their prices.

- Lower Borrowing Costs: Companies issuing investment-grade bonds can refinance existing debt at lower rates, reducing their interest expenses and improving their creditworthiness. This increased financial stability can lead to higher bond prices.

- Increased Demand for Yield: In a low-interest-rate environment, investors seeking higher returns may shift from government bonds to higher-yielding investment-grade corporate bonds. This increased demand can push up bond prices.

- Reduced Default Risk Perception: Lower interest rates can stimulate economic growth, improving the overall business environment. This can reduce the perceived risk of default among investment-grade issuers, making their bonds more attractive.

- Relative Safety: Investment-grade bonds are considered safer than high-yield (junk) bonds. In a low-rate environment, investors may prefer the relative safety of investment-grade bonds while still seeking higher returns than those offered by government securities.

Treasuries

- Price and Yield Inverse Relationship: Bond prices and yields move inversely. When the Federal Reserve cuts interest rates, the yields on newly issued Treasuries fall. As a result, the prices of existing Treasuries with higher yields rise, making them more valuable to investors.

- Increased Demand for Safe Assets: In a low-interest-rate environment, investors often seek safe-haven assets. US Treasuries are considered some of the safest investments in the world due to their backing by the US government. This increased demand drives up their prices.

- Portfolio Rebalancing: Institutional investors, such as pension funds and insurance companies, may rebalance their portfolios to maintain a desired mix of assets. Lower interest rates can lead these investors to increase their holdings of Treasuries, further driving up prices.

- Expectations of Further Rate Cuts: When the Fed cuts rates, it may signal the potential for future cuts, especially if the economic outlook remains uncertain. This can lead to increased buying of Treasuries as investors anticipate further price appreciation.

- Economic Uncertainty: Rate cuts are often implemented to support the economy during periods of uncertainty or slowdown. During such times, the demand for risk-free assets like US Treasuries increases, boosting their prices.

- Flight to Quality: In times of economic stress or financial market volatility, investors often seek the safety of US Treasuries. Even if the rate cuts are meant to stimulate growth, the initial reaction can include a flight to quality, supporting Treasury prices.

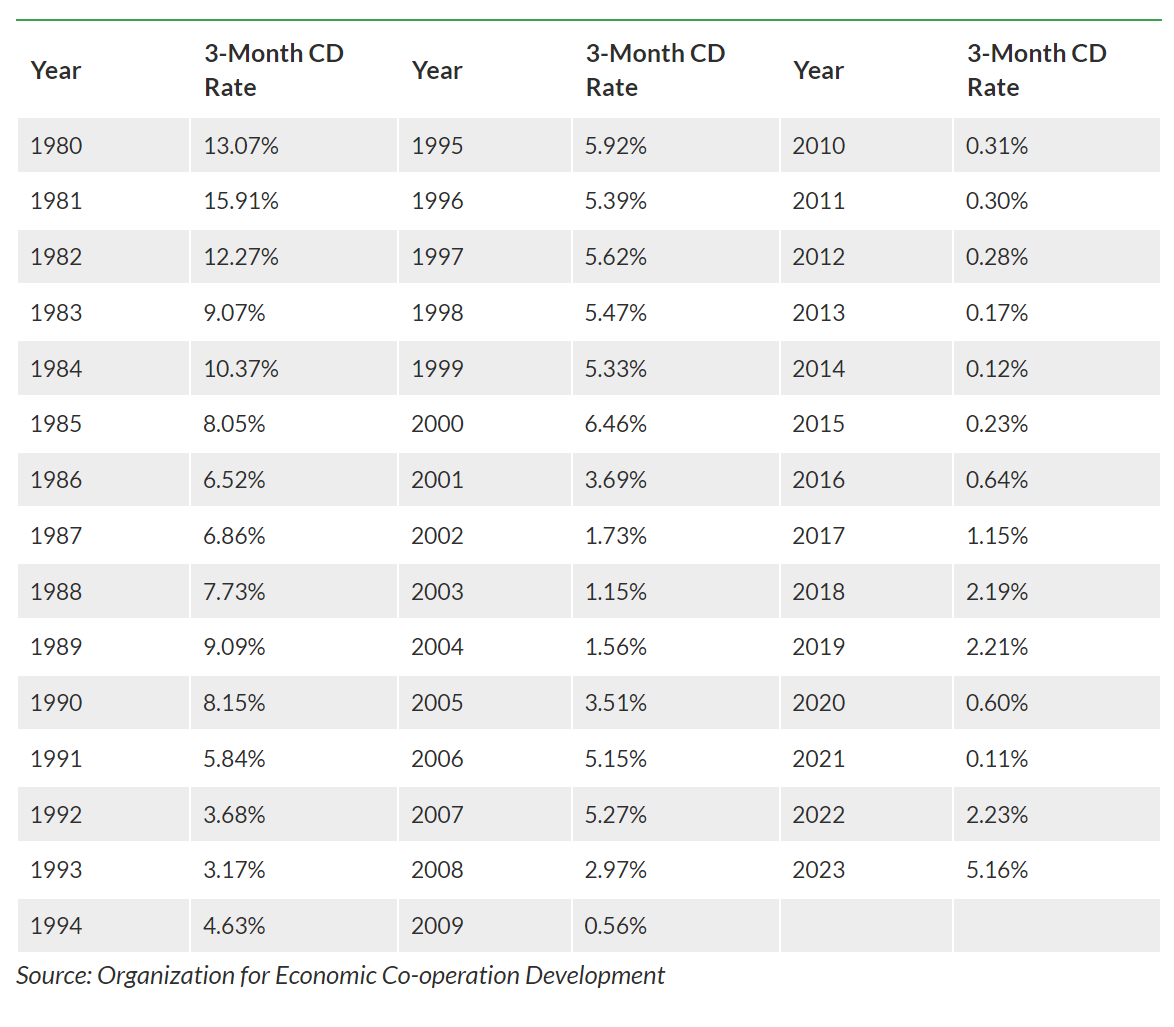

CDs

When the Federal Reserve starts to cut rates, usually that will most impact the short end of the yield curve. For the past few years 5% on the short end of the yield curve was commonplace. These rates have already started to creep down and will likely drop further, even just in anticipation of the coming rate cuts. So, for all those CD lovers out there, if you stay on the short end where banks may still be offering specials that are close to the 5% range. If you wait, it may be a while before we see 5% again.

Loan Refinancing

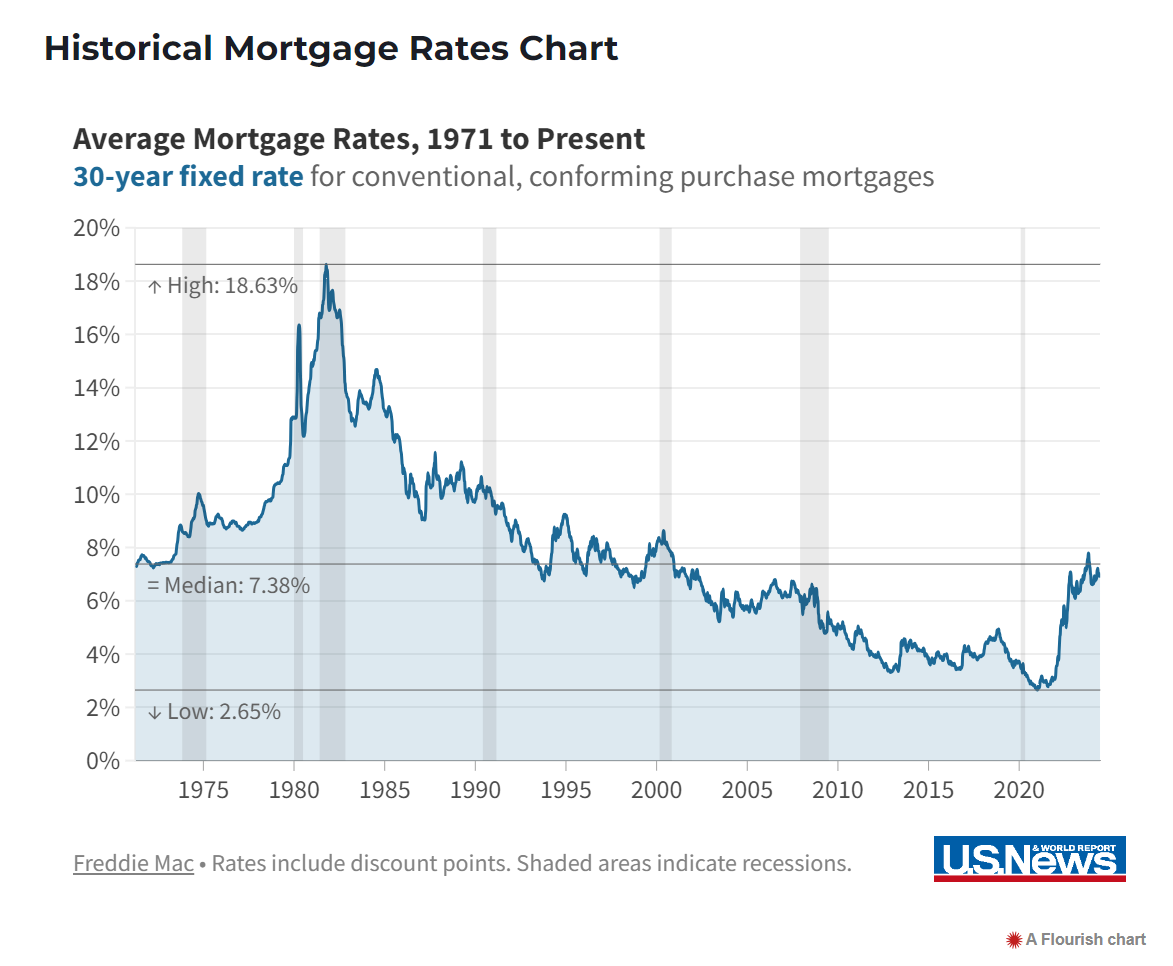

Home Mortgages

If you are among the blessed mortgage holders that either bought a property or were savvy enough to refinance when rates went down below 3%, skip this paragraph. You aren’t going anywhere for another 20+ years it would seem. For those of you planning to buy a primary, vacation or investment property, rates have already started to fall in anticipation of the Fed cutting rates. If we see multiple rate cuts for those that bought a home in the last two years, this may present an opportunity to refinance with the goal of lowering your payment while not extending your term by a significant margin.

Student Loans

Student loans can be either Federal loans or private loans through a bank. Private student loans offer the potential opportunity when rates start to fall. Student loans, like many other consumer loans, are eligible to be refinanced. The typical private student loan is a 10–20-year payback term reducing the interest rate can have an impact. It is worth noting that if you choose to refinance and the term is extended, you should be able to lower your payment but, it is important to keep in mind how much additional interest will be paid over the life of the loan. Federal loans are treated differently, they can be consolidated (versus refinanced) whereby multiple loans are being combined to fewer loans and an average of the interest rates on the original loans are then applied.

In closing, we are about to embark on a new phase and with that will come the necessary adjustments, on balance lower rates are more likely a good thing than a bad thing, after all interest is the cost of money. We will monitor the possibility that lower rates have a bit of a self-fulfilling effect whereby consumers and companies see that rates are in fact really coming down, not just being talked about. The risk is that, with the idea of holding out hope for even lower rates by delaying purchases and investment, the softening of demand results in further cooling and labor softening. Many have speculated that one of the reasons for the slow recovery after the financial crisis, aside from the scars that period ushered in, was the lack of urgency on the part of consumers and corporations alike as rates where likely to be lower for longer in the new zero interest rate period or “ZIRP” regime.

The views expressed represent the opinions of Breakwater Capital Group as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2, available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.