August Angst is back: Are we still running with the bulls or has the bull been run over?

As has been the case for 3 years running, August has been a difficult month for the markets and as we type, we are in the midst of a sharp increase in volatility and the selling pressure that often accompanies it. The proximate cause changes from year to year, in 2022 it was Fed Chairman Jay Powell’s “pain” comments about what lay ahead for both Wall Street and Main Street, while 2023 was a concern that the economy may in fact be overheating and the next move for the Fed was perhaps another hike. In 2024, it’s been about rising unemployment and the Sahm rule, along with some other data points that show the economy is slowing.

While all real concerns, then or now, generally the market follows a familiar script where emotion meets some disappointing data results in a narrative shift and the worst possible scenario comes to the fore. A weekly unemployment claims report on Thursday morning that showed higher than expected new filings, was followed by a disappointing Manufacturing ISM survey which showed that part of the economy was contracting, though interestingly enough the NonFarm Payroll report for July, released on Friday, saw employment increases in construction, transportation, and warehousing. The “Jobs Report” as it’s often referred to, is an important data point, one of many, and the combination of a lackluster headline number (114K new jobs versus 175K predicted) along with 29K of downward revisions for May and June left people worrying that the labor markets were rolling over. Aside from the tepid job growth (growth being the operative word here) itself, a decrease in hours worked and an increase in the unemployment rate from 4.10% to 4.3% seemed to be enough to get the market convinced that it was time for the exits. We have had a couple questions related to the report, as you might imagine, one of the more common inquiries is how are we adding jobs yet seeing a jump in the unemployment rate. That phenomenon relates to an increase in the participation rate where more people actively seeking employment versus prior months means a larger pool of workers came into the survey vs. the total number of new hires. There are other wonky features to these reports, the other reports from the Bureau of Labor Statistics where they try to smooth out the data. The summer and winter months tend to be rather noisy related to weather patterns along seasonal employment trends (i.e. new college grads entering the workforce or students working summer jobs.)

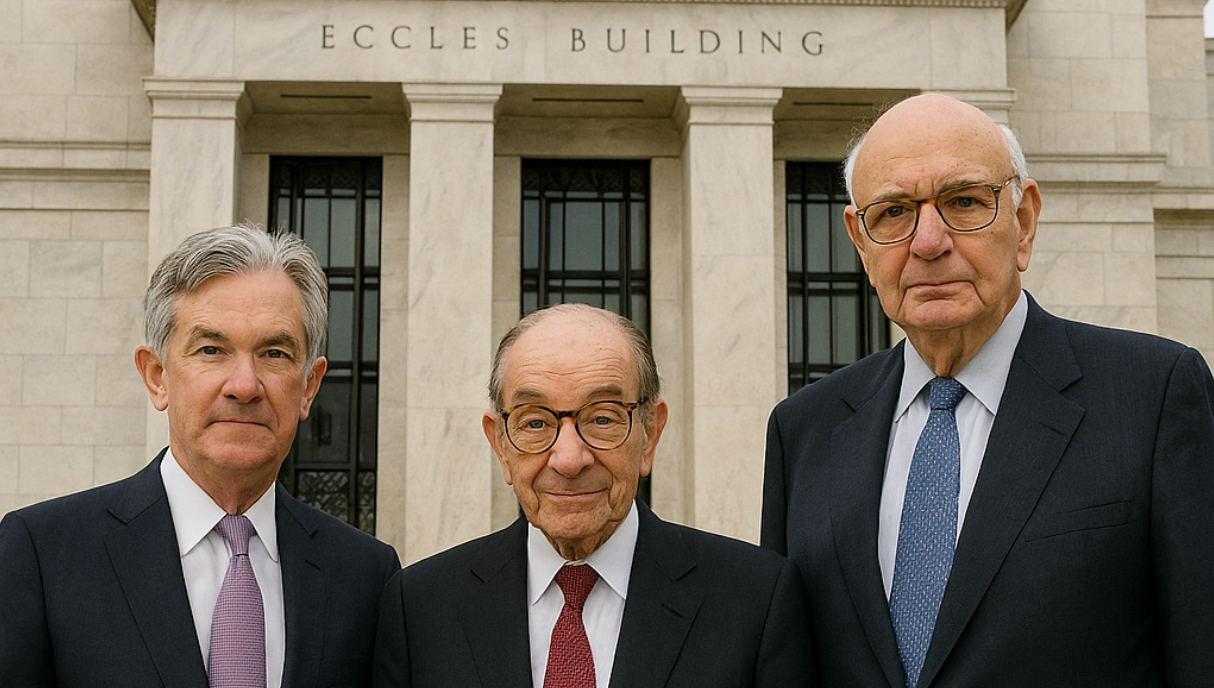

There has been much hand wringing about the Fed behind the curve, but they have no record of ever being accurate ex ante, we could be talking about Bernanke whistling past the graveyard when referring to the subprime risks being contained back in 2007 or the March 2022 liftoff of the most recent tightening cycle where inflation was already well on its way to peaking at 9.2% later that same year. The Fed, like all of us are human beings and prone to the same failings and we are somewhat misguided to put them on a pedestal as some clairvoyant policy mechanism. James Mackintosh’s piece in today’s Wall Street Journal does a nice job in summarizing several instances where market structure contributed to the big market moves in 1987 and 1998 where an otherwise lousy headline may have just meant a day’s decline morphed into something a bit bigger.

It is safe to assume the economy has slowed down from the blistering pace we saw in 2021 and 2022 and saw some hints at in the back half of 2023, but we should expect the economy to go through periods of acceleration and deceleration from time to time. You’ll hear the word recession even more and more, partially because it seems intellectual to seem bearish, but the fact is there is always the possibility of a recession on the horizon whether due to an exogenous shock or the ebbing of the business cycle as animal spirits are exhausted and the credit cycle shifts. We sympathize with those of you spooked by the chatter about a more uncomfortable period ahead though there is no guarantee that is what transpires. In the last 48 hours, you may have heard multiple references to the aforementioned Sahm Rule which suggests that by the time the unemployment rate has jumped by .50% in the span of 6 months we are already 3 months into a recession or Goldman Sachs ratcheting up the prospects for a recession in the next 12 months from 15% to 25%. Ms. Sahm, an economist, acknowledged the limitations in her model and the obvious fact that we are at a time where there has been a good deal of distortion related to the pandemic and its aftermath, especially related to the unprecedented policy response. You may recall hearing about the inverted yield curve’s undefeated record when it comes to predicting recessions back in 2022, though 24 months later it seems that record may no longer be unblemished. To quote George Box, the famed British statistician, “all models are wrong, some are useful.”

There are a number of important data points ahead, and while the next Fed meeting is not until September 18th, if the policy makers see a reason to act prior to then, they will. It likely will be in response to the “growth scare” versus proactively addressing pernicious events a few quarters out but we will have to wait and see. Further evidence of the market wanting to look for the negative news flow, it shrugged off the Service Sector ISM which accounts for 70%+ of the economy and was firmly in expansion mode.

As long term investors, it’s best to take any and all data in stride and consider it in a broader context, the bright spot is for investors with diversified portfolios, the last month you have seen the benefits of holding bonds to offset the equity declines, something that we didn’t see in 2022 when both assets classes ended the year down sharply. Over that same timespan we have seen sharper declines in technology or technology adjacent industries (communication services, and consumer discretionary sectors) whose stocks had gone up an eye watering 48% since last October when looking at the Nasdaq composite. Despite the selling pressure many stocks still appear fully if not overvalued given the fundamentals, so it does not appear a massive snapback rally is in the cards as was the case in 2020 or early 2023 when various ratios came back to levels in line with historical averages.

Your instincts may suggest to sit this one out and go to the sidelines for a little, but some of the markets’ better days are often in the midst of volatile periods like this and after having already realized some of the declines you may very well be making a poor decision to compound those losses. Citing a slide from our recent market update, courtesy of the folks at Schwab & Bloomberg, if you missed the ten best trading days over the last 2520 days (20 years) you would have captured only 60% of the market’s long run return. Actions like this have a meaningful long-term impact on your results.

It’s not to say times like these are to be dismissed, and you should go about your summer plans. And in one of the few instances where I disagree with Warren Buffet who in 2015 said “if you are worried about corrections, you shouldn’t own stocks.” It’s okay to be worried, you have worked hard for your money and have goals associated with it. Perhaps better stated he might have said that if a correction makes you want to sell your stocks, you may need to revisit your allocation. Periods of episodic volatility can be extremely valuable in that they allow you to be better informed of your risk tolerance. If you feel like the last few weeks are untenable, be sure to schedule some time with your advisor to review the merits of your approach or any change that may be appropriate.

Sources: Bloomberg, Charles Schwab & Co, Barron’s, WSJ, CNBC

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.