Will August Angst Lead to Feel Good Fall?

Will the Bull Market Rally Give Up the Ghost or Will We Have a Feel Good Fall?

As we wind down the summer, with kids back to school and work returning to something resembling a five day a week proposition, it has become an annual ritual to discuss the traditionally volatile months that usher in the Fall. Below are the YTD returns for major averages as of close 9/12/2023:

- S&P 500 Index: 17.57%

- Nasdaq Composite: 32.64%

- Dow Jones Industrial Average: 4.31%

- MSCI EAFE: 9.78%

- MSCI Emerging Markets: 4.24%

- BBg US Aggregate Bond Index: .63%

Interesting fact: Even after a bumper 2023 for the S&P 500 thus far since the start of 2022, it’s simply 1.2% higher than the Dow over the same 20+ months.

While we have seen market declines for each of the last three Septembers, October, on the other hand, has been far kinder, with gains of nearly 7% in 2021 and 8% in 2022. By now we should all know that trading the calendar is hardly a recipe for sustained success, after all that would be far too easy. After a torrid start to 2023 through the first seven months of the year, a disappointing August and slow start to September has restored the universe to a more balanced level of investor sentiment. There seemed to be a building level of ebullience and with valuations full, if not stretched, the possibility of detachment from reality seemed altogether likely if not inevitable by late July. While I hate the phrase “market correction” as it implies the market is not reflecting the proper price of assets, an oxymoron if there was such a thing, periodic selling pressure can do some good. It’s difficult to put a finger on any one cause and we perfectly understand if you are somewhat spun around by all the seemingly contradictory data these last couple months. Just be happy you are not a central banker, posh room in Jackson Hole aside … With the hope of providing some clarity we thought it would be worthwhile unpacking a number of key areas of focus for the months ahead. Perhaps it will be a good sleep aid as well.

Earnings: Time and again you’ll hear the phrase that earnings drive stock prices and with discounted cash flows, still the preferred method for valuing assets better, or at least, less bad earnings should see prices increase. So, with 2’Q earnings coming in better than expected, why did stocks not respond more favorably to the numbers? According to FactSet, 79% of companies beat their earnings estimates (above 5-year average) with 64% beating on revenue (below 5-year average). Earnings are down about 4.1% year over year and witnessed a decline of 7.00% for the second quarter in what is likely to be the trough in this cycle. A weaker top line suggests some softening in demand, so that’s worth watching as there is only so much you can do with cost cutting and financial engineering. Guidance for 3’Q has improved somewhat off a low base and suggests year-over-year earnings growth of anywhere from 1-3%. As we wrap up 2023, earnings improve more sharply in the 4th quarter and into 2024 where low double digits have been penciled in. Given that markets are forward looking some of that is already reflected in prices. If earnings do in fact grow at those levels, stocks can support further gains, though they are likely to be modest given higher interest rates and full valuations with the S&P 500 trading around 18.5 on a forward basis.

Inflation: There has been encouraging news when it comes to the rate of price change, thus resurfacing the transitory argument, as supply chains continue to improve should demand remain at the current level there may well be some disinflation if not deflation on the horizon. The Fed’s preferred measure of inflation, core personal-consumption expenditures (PCE) came in at 4.2% in July when measured year to year, but on a month-on-month basis, prices increased at .20%, the lowest going back to March 2021. Headline inflation is likely to jump back up for August and possibly in September based on higher gasoline prices and some weather-related factors impacting food prices. Industrial metals have been marching higher based on an uptick in demand. The trend however is for inflation to continue to decline and as Fed Chair Jerome Powell stated unequivocally in Jackson Hole, that the target remains 2% even if it takes until 2025 to get there. Housing, which is measured as owner’s equivalent rent in the PCE measures, is likely to be a drag on inflation based on higher rates sapping demand for existing home sales and actual rent growth falling sharply after some catch up in 2021 and 2022 based on concessions made during the pandemic. For the August CPI release much was made of the core level being elevated yet the market shrugged off the “hotter number” mainly because it has done little to change the narrative around disinflation, looking at this data over a rolling 3 months is a better way to see whether or not there are real trends emerging versus one month’s report which is surely impacted by noise.

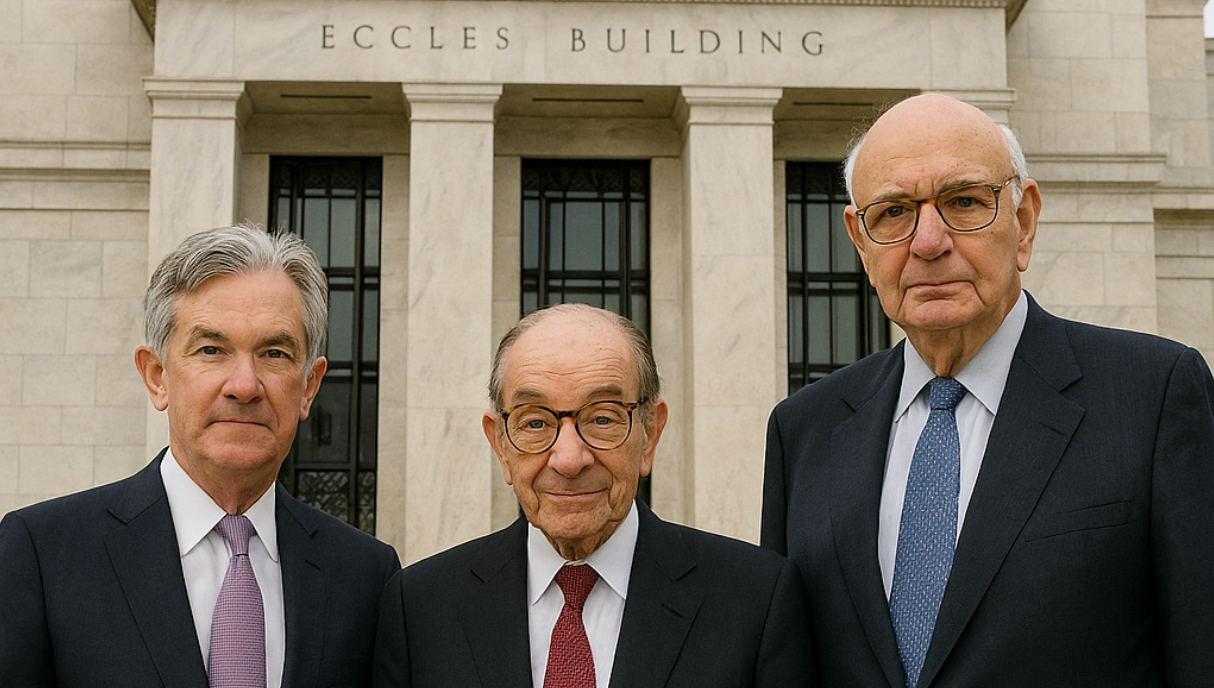

Federal Reserve: June’s meeting brought the “pause/skip debate” but that was put to rest after the July meeting offered a 25-basis point hike, the 11th of this cycle taking Fed funds to the highest level since 2000. While the drumbeat from the various Fed governors is that they intend to take a wait and see approach, at this point my sense is that they are done hiking rates this cycle. Having adequately tightened monetary supply by hiking rates over 5.00% while shrinking their balance sheet by nearly $1TT the Fed has cooled down housing, increased the overall cost of borrowing and indirectly drained the animal spirits from the capital markets as evidenced by the decline in asset prices over the last couple of years. Hardly time to say, “mission accomplished,” a good deal of progress has been made. For the better part of the last 2 years, risk of not doing enough clearly outweighed doing too much, but several data points suggest that further tightening here could result in something else breaking (aside from a few banks) and with little appetite for a policy response from the Fed itself and nothing coming from the fiscal side, that seems imprudent. While we still wait for the lagged effect of tighter monetary policy, one place where the impact is felt more acutely and quickly is within the currency market, something I opined about last Fall when highlighting why a strong dollar was a source of concern. As the dollar has strengthened again quite a bit recently, it was on an 8-week winning streak the longest in nearly a decade and up 5% since early July the greenback has put pressure on various currencies around the world from China to Japan as well as UK and the EuroZone. While a weaker local currency can help export driven economies, it essentially means you are importing inflation at home, something the Europeans would greatly like to avoid having dodged an energy crisis last year with the invasion of Ukraine. Germany, the manufacturing powerhouse of the EU, would have benefited from similar dynamics in the past, but the weakness in China, a key trading partner, has made stagflation a real concern for the 4th largest economy in the world. More on this in a moment

Labor: Another Goldilocks nonfarm payroll report for August. The combination of job gains (187K), along with an increase in the unemployment and participation rates all while seeing hours worked increase and hourly wages increase more slowly (.2% month on month) suggest a cooling labor market. This was the equivalent of walking on water and just what the Fed has been hoping for if a soft landing/no landing is possible. With inflation being front and center the last couple of years, you’d be forgiven if you forgot that the Federal Reserve has a dual mandate to control inflation and target full employment. To temper the overly optimistic tone somewhat, we witnessed a decline in available jobs and a decline in quits in the Job Openings and Labor Turnover Survey (JOLTs) suggesting employers are getting a little more cautious as are employees. While labor is historically one of the key drivers of inflation, wage growth is only modestly higher than the projected 5-year inflation rate suggesting the vicious wage price spiral of the 70s is not likely to repeat. All eyes on the UAW strike, but keep in mind their 150,000 members represent about 1/10th of 1% of the working population in the US. Larger employers like Walmart, which employs over 1.6MM Americans have actually been cutting wages for new hires as the competition for jobs has abated in the last couple months.

Retail Spending: The endless debate on when and if consumers will run out of their pandemic savings has been going on for about a year and I still see the estimates ranging from $500BB to $1TT with estimates that it will be exhausted in about a year’s time. That may well be the case, and some indicators like increased credit card borrowing suggest we may be closer than we think, but healthy labor markets are able to cushion the impact here. After a .7% increase for July, only a .2% increase is forecast for August but that’s still healthy by most standards, especially for what is typically a less active month. As has been the case for much of the last decade there is a certain consumer whose demand is less susceptible to economic conditions as solid earnings from the likes of Lululemon suggest.

Sentiment levels: At one point with the market within 5% of it’s all time high, achieved on January 3, 2022, the S&P has given back about 3.5% of the profits and investor’s moods have shifted. Back in July, the relative strength index (RSI) was consistently logging figures in the mid to high 70s suggesting the market had become overbought, we have drifted back to around 50, which while not quite oversold levels seem to indicate there is less froth out there. CNN’s Fear & Greed index has returned to a neutral reading from Greed a month or so ago and while the market volatility has dropped sharply there is a bias to negative skew meaning the cost of hedging has increased somewhat as stocks have given back some gains. There are some technical factors that are flashing yellow signals whether they be leading economic indicators that have rolled over and have been at recession levels for the last 12 months, granted those measures are focused more on durable goods and stocks are very close to their 50-day moving average suggesting if support is broken the next move may be lower.

China: One of the biggest questions on everyone’s mind is what is going on with the world’s second largest economy where growth and trade have disappointed all year despite emerging from Covid lockdowns. With stimulus targeted more at business versus everyday consumers they did not see the inflationary effects witnessed in the West, but their economy remains far too reliant on the commercial real estate market and manufacturing, the former having been a problem since 2015 and the latter coming more into focus with supply disruptions related to the pandemic. With China accounting for nearly 20% of global GDP yet only 12% consumption according to Michael Pettis, the argument is that it’s necessary for China to focus on consumption growth over the next 10 years at the expense of inefficient GDP growth. This would entail a rather large philosophical shift where the state would essentially look to transfer more wealth to the consumer through assets sales and social safety nets, something that they have been loathe to do at this point. It’s worth experimenting with as the current path seems likely to ignite pushback against Xi’s policies and suggest this may be his last 5-year term as leader of the Middle Kingdom. This may be too logical or optimistic, it would be a boon for US companies and perhaps even the Chinese stock market, but I am skeptical they will be willing to undergo such a drastic policy pivot and undertake the needed reforms. Both China and the US need each other as the rest of the world seems hardly up to the task. A healthy level of competition can be productive, see the Space Race or DARPA versus a more hostile policy of containment which increasing the odds of further frictions adding costs but for now China looks to be worth passing on until they embrace a model that hasn’t been working for the last 8 years or so and stop scapegoating the West.

In summary, the next couple of months may remain a bit choppy; on balance the economic backdrop at home has improved and the fact monetary policy should be more consistent should mean stocks can better discount the future. Should we see any improvement abroad that should power markets back to the levels from late July if not higher. There is reason to be optimistic out there and as my 5-year-old gets excited about Halloween, I get the sense that the 4th quarter may be more treat than trick this year, but time will tell. The bigger question is how many times the costume may change between now and then.

For those who endured, thanks for reading, feel free to share this and our other timely content with anyone who would benefit from our perspective.

SOURCES: Barron’s, FactSet, WSJ, Bloomberg, FT, Charles Schwab & Co LLC

The views expressed represent the opinions of Breakwater Capital Group as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. https://adviserinfo.sec.gov/ Past performance is not a guarantee of future results.

The Dow:The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chipstocks. The market index is unmanaged. Investors cannot directly invest in the above index.

NASDAQ: The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers AutomatedQuotation System. You cannot directly invest in this index.

S&P 500: The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to berepresentative of the stock market in general. You cannot directly invest in this index.

MSCI EAFE: The MSCI EAFE Index (Europe, Australasia, Far East) is designed to measure the equitymarket performance of developed markets outside of the U.S. and Canada. You cannot directly invest in this index.

MSCI Emerging Markets: The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries*. With 1,421 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Bloomberg US Aggregate Bond Index: is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

The market indices discussed are unmanaged. Investors cannot directly invest in unmanaged indices.

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.