Sound and Resilient

The title of this piece was taken from the opening remarks from Fed Chair Jerome Powell as he kicked off his press conference on May 3rd, shortly after the 10th (and likely final) rate hike of this tightening cycle. About 30 minutes later during the Q&A, a member of the audience asked if he had any regrets about decisions that had been made during his 5+ years at the helm. I don’t think it would be a stretch to say he probably wishes he hadn’t uttered those words to describe the banking system no more than an hour prior. With regional banks continuing to wobble it seems like it may be a little premature to do a victory lap. Though he was not alone, as Jamie Dimon shared a similar ill-timed or seemingly out of touch perspective after winning the right to pick over the carcass of First Republic Bank earlier in the week when he said this part of the crisis is over.

There are plenty of axioms in the world of finance, many of which revolve around the Fed, the most popular of course is “Don’t Fight the Fed” but the one getting a little more airtime of late is that the “Fed Reserves raises rates until something breaks.” Be that as it may, it is still hard to fathom the benefit of the current approach where after 10+ years of extremely accommodative policy such an abrupt shift in policy was bound to have significant implications. Recall, it was just last March when rates were effectively zero and the Fed was just winding down its latest Quantitative Easing program. Since monetary policy has been known for its “long and variable lags” it should not come as a surprise that we are now starting to see the impact of this aggressive policy path to contain inflation.

The collapse of both Silicon Valley Bank and Signature Bank seemed to be a perfect opportunity to take a step back and allow things to settle down. Rather than pause however, the Fed raised rates 25 basis points in back to back meetings even while citing the increasing likelihood of a recession later this year when they convened in March. Powell walked that back when asked Wednesday afternoon. So what’s behind the seemingly stubborn approach? While it hasn’t been explicitly cited, perhaps because it is a political flashpoint (cue Elizabeth Warren), but most economists believe Powell & Co are using the Taylor Rule and Phillips Curve as their guides with a heavy emphasis on the Non-Accelerating Inflation Rate of Unemployment (NAIRU). Are you confused yet? It’s okay, just be glad it’s not Alan Greenspan trying to explain what’s going on.

In plain English, these theories posit that there is an optimal level of unemployment and that in fact very low is not necessarily a good thing. When the labor markets get too tight, wage pressure leads to higher prices resulting in inflation expectations becoming entrenched and thus the start of a vicious (the opposite of virtuous) cycle takes hold. But what if this approach is incorrect, for the better part of the last year we have witnessed decelerating inflation (albeit perhaps not decelerating enough), yet hiring continues at an impressive clip while the unemployment rate has fallen further. There have been other periods where there is limited correlation with the employment rate and inflation, see the late 1970s and early 1980s when both registered double digit levels (1982.) It’s quite evident that much of the inflation the last few years has been the result of pandemic related supply shocks but what if the Fed’s hawkish rhetoric is fueling demand itself.

I’ll give you a simple example, which anyone who has been around little kids can relate to. I have a 4 year old and at that age most young people haven’t honed their skills around discretion and frankly his diet leaves much to be desired. One night at dinner time, he was eating M&M’s by the handful, concerned he would no longer have any appetite when his food was ready, I asked why he was shoveling them down so quickly to which he replied “because you’re about to tell me I can’t have any more.” And you know what, he was right, I had intended to take them away from him, but not before he was able to gorge himself on them to the point he was no longer enjoying them. I am convinced that the Fed has been ineffectual in stamping out inflation with the current monetary approach, but in fact exacerbated the problem. You only have to look at the US or Europe for the last 10+ years to see benign inflation despite negative real and even nominal rates, in Japan it’s been a 30+ year phenomenon. Assuming that people are generally rational in the aggregate, then supply and demand should be in balance much of the time. However, when you couple an environment with disrupted supply (pandemic, War) with augmented demand as people race to get ahead of potentially higher costs, you are telegraphing to them they are destined to bid up the price of goods and now services. Demand would likely have petered out independent of monetary policy, it just required a bit more patience. To be clear, I am not a proponent of lower forever, rates were too low for too long which had the potential to encourage risk taking and moral hazard while distorting asset prices. If the Fed continues to believe that long run inflation is likely to be around 2%, taking rates to 3% would have been a good place to start, but we blew through that level by the Fall of 2022 and now they have created a mess and seem reluctant to recalibrate.

Instead of complex econometric models, simply picking up a 10th grade physics textbook would have offered some valuable insight. Most of us recall Newton’s 3rd law which states “For every action, there is an equal and opposite reaction.” When you raise rates faster and higher than you have in 40 years there is going to be some real repercussions. So how do we go about fixing this mess? With a recent Gallup poll showing 50% of Americans having some concerns of the safety of their bank assets, that’s an alarming statistic and means the risk of further deposit flight remains elevated. To shore up confidence, there are likely a few steps to consider:

- Prevent future sweetheart deals where banks are incentivized for holding off acquiring a struggling bank only to wait to swoop in after the government offers favorable terms. JP Morgan doesn’t need any extra advantage, the same goes for the other big banks.

- Consider banning short selling or buying credit default swaps on banks during this time of panic, in 2008 shortly after Lehman’s bankruptcy the SEC banned the practice for about 2 weeks.

- Recapitalize the banks through senior preferred securities, where the taxpayer stands to benefit when the situation calms down. We provided loans to the airlines during the pandemic, they survived and are doing fine now as travel has returned to prior levels.

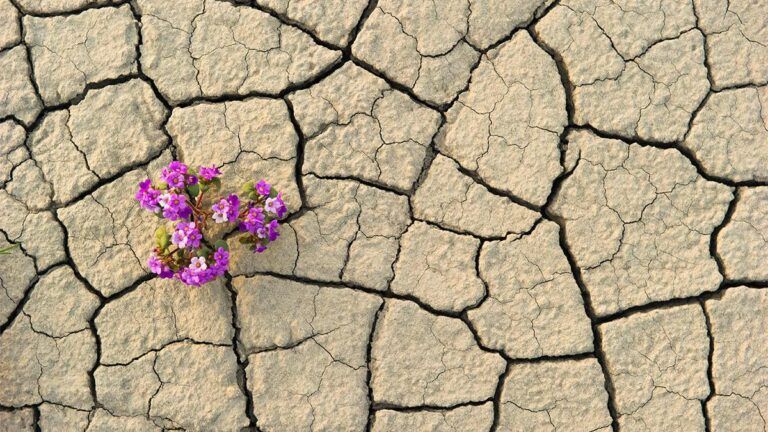

Whether or not Powell believed that line or it was a bit of puffery can be debated. Fortunately, the US economy is sound and resilient and in the face of this challenge will emerge hardened and stronger as it has done time and again. With another solid Nonfarm Payrolls report, a housing market that has found better footing and a positive earnings picture there is reason to be optimistic even if some days it seems like the policy makers are whistling past the graveyard. Oh and don’t get me started on the folks in Washington. Thanks for indulging me with your time.

Sources:

National Bureau of Economic Research

Bureau of Labor Statistics

Bloomberg

Factset

https://news.gallup.com/poll/505439/half-worry-money-safety-banks.aspx

Disclosure: This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.