Market Commentary

Overview

It’s been about a month since I posted last, where I opined about the difficulty in forecasting the year ahead. I think it’s safe to assume, as I asserted at that time, that no one would be able to provide any real clarity. That’s not to say there isn’t value in looking at the data and gauging sentiment, it’s more

about acknowledging the difficulty in synthesizing all of the information. After all, how many of us can predict what we will have for lunch three days from now.

As we wound down 2022, where the S&P logged an 18% decline for the year, the worst result since the Great Financial Crisis, the consensus view was

that the beginning of this year would be much of the same.

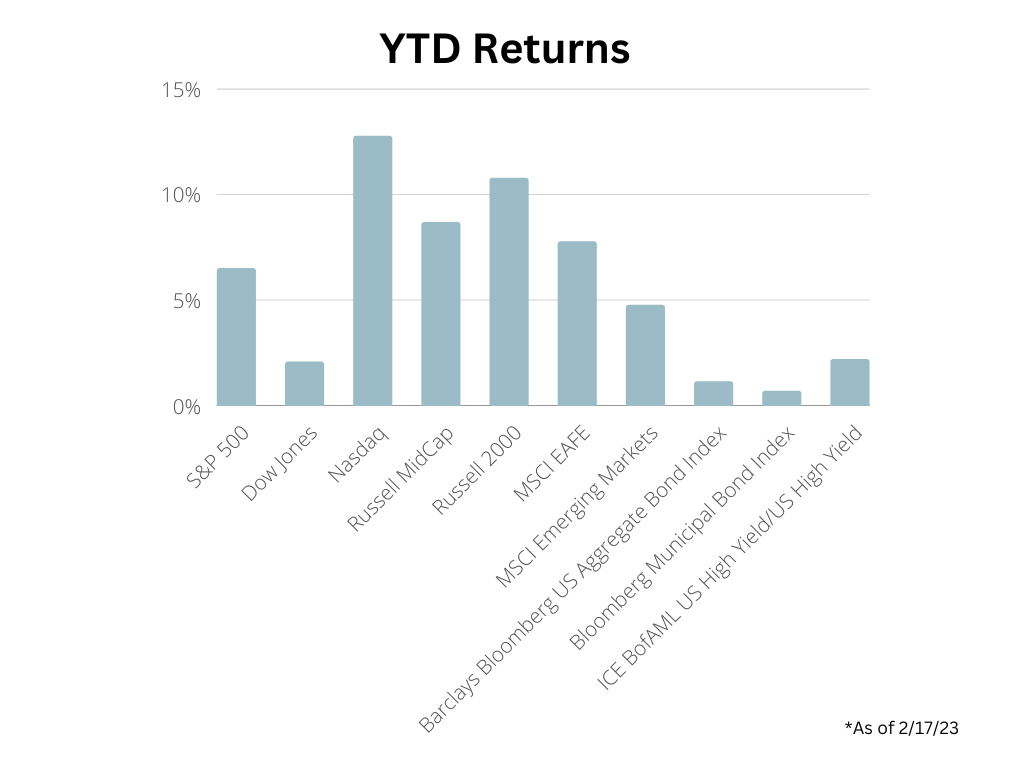

The first part of the year would see risk to the downside based on margin compression or worse earnings rolling over, along with the tightness in the labor markets forcing the Fed to remain hawkish for longer. It would be in the second half of the year, where the Fed’s pause and the possibility of rate cuts later in the year or early next would set off a more sustained rally. As of the close of business on Friday, February 17th, here are the returns for the major indices:

Not exactly lining up with consensus is it? It’s clear that the “risk on” mentality drove asset prices higher out of the gate, case in point Bitcoin is up about 50% on the year and we have seen pockets of meme mania resurface. I’ll refrain from adding much there since those examples seem entirely detached from

fundamentals or reality for that matter, but we have seen some of the Tech heavyweights show signs of life, with the likes of Meta Platforms up nearly 40%. So what gives… First, it’s important to recall the market’s discounting process and the potential for the capital markets to provide insight into what is in store for the economy over the next 6, 12 or 18 months.

At times in 2022, we witnessed sentiment plumbing lows last seen during the financial crisis, and the combination of very depressed investor and consumer confidence meant we were bound to see some improvement without requiring much in the way of good news. That “good news” has been the combination of decelerating inflation, or what has lately been coined “immaculate disinflation” offending both Christians and Steeler’s fans alike, along with a labor market where unemployment recently hit 50 year lows.

It will be worth taking a closer look at those factors among others to see if there may in fact be further room for the market to run in 2023.

Peak Inflation or Transitory Disinflation?

In our January quarterly market update webinar we lamented the fact that the definition of transitory has become a debate about semantics. The idea we could see inflation or disinflation remain elevated (or depressed for 2-3 years) seems entirely in line with using the word temporary, or its synonyms, as an adjective to describe the phenomenon. Should inflation last longer than that, it’s fair to say it’s become structural, but we aren’t quite there yet. Last June’s 9.1% CPI print represents the peak for this cycle thus far and we have witness a decline now for the better part of 7 months, with the Valentine’s Day Consumer Price Index announcement coming in at 6.4%. A favorable trend, but still high nonetheless, if you assume that the inflation makes its way down to 3-4% territory by year end, below Fed Fund’s current 4.50-4.75% range even before the likely rate hikes in March and May, then it’s safe to assume the current monetary policy is restrictive enough to see some impact on economic activity and further cooling and the Fed may be able to take a victory lap. It’s all about those long and variable lags, they may just be taking longer and be a bit more variable than the theoretical constructs found in economic textbooks. On the other hand if inflation remains elevated forcing the Fed ever higher, they may very well have to take overnight rates above their preferred inflation measure (PCE) which means we could be looking at high 5s or even into 6% territory. I get the sense that we are still headed in the right direction and some recent data may in fact be more of a blip than a reversal of the trends seen since last summer.

There has clearly been some impact associated with the most restrictive rate policy in the last 40 years, you only have to look so far as housing to see it. When the 10 year Treasury touched 4.20% last October we saw rates as high as 7% for 30 year fixed mortgages taking the wind out of any potential buyers sails. The case for the Millennials and Gen Z remain intact as the next source of secular demand, but the combination of high prices and rising financing costs may mean another generation remaining renters longer than they may have hoped. Housing activity’s slump coupled with poor builder sentiment have been on display for the better part of 6 months. The next 2-3 months, as we enter the peak selling season will set the tone for the remainder of the year for shelter costs a large input in the inflation measures, in looking at Home Depot’s recent guidance don’t expect any miracles here.

In summary, the Fed seems poised to avoid the mistake of the 1970s where Arthur Burns prematurely declared the war on inflation over only to see it come back with a vengeance. It wasn’t until Paul Volcker, who was appointed in 1979 as Fed Chair, slammed on the brakes in1981, taking Fed Funds as high as 22%. We won’t see rates that high, of that I am certain, it’s just trying to game out then when and how high that seems to be the most interesting parlor game in town. The combination of aging demographics, improved technology and debt crowding out some investment makes it highly unlikely to see inflation remain elevated for a period that would not meet our definition of transitory.

Labor Markets and Wages

If you assume that much of the inflation from the last 2+ years is a byproduct of supply chain disruptions and distorted demand based on the pandemic then as we get into the back half of 2023 we should see inflation come down in a more meaningful way. When there imbalances in the traditional supply/demand relationship it’s not uncommon to see a very noisy period for the price of goods and services. Where inflation tends to be more of a long term issue is when there is a sustained level of increased discretionary income, usually found during bull markets or periods of above average wage growth. The headlines of late have generally been focused on layoffs at the large tech firms, yet we have not seen any appreciable change in weekly unemployment filings, in fact they remain below the long run average of 200K which has been the norm in non-recessionary periods, adjusted for population growth. This may be the result of service dates ending several months out or severance packages, though anecdotally many of those impacted have been able to find jobs rather quickly. In fact at the beginning of this month, the Job Openings and Labor Turnover Survey (JOLTS) revealed there are 11.0 million openings which is nearly 2 jobs available for every available person in the labor pool. This is telling, workers still have the upper hand at the negotiating table, whether seeking higher wages or “improved” working conditions, the latter evidenced by major metropolitan office space with occupancy rates below 50%.

One close look at the Atlanta Fed’s wage growth tracker illustrates the step function that occurred in late 2021 when wage growth jumped from the 3-4% which had been the norm since 2015 to over 5% before topping out just short of 7%. With inflation running hot, there was no real wage growth, but as

inflation has cooled, if wage growth remains above trend that could put a floor on inflation while also having an impact on margins. Despite the purported “labor gains” I am dubious that there is any real improved bargaining power, businesses have been remarkably adept at squeezing out cost efficiency going back to the GFC. While we may not see the large increase in layoffs, expect nominal wage growth to settle down later this year into next.

Corporate Profits & Margins are Under Pressure

As we wind down Q’4 earnings season, this week we have heard from retailers like Walmart and TJX who have offered a bit of a mixed picture, it’s safe to describe the last 3 months of 2022 a lackluster quarter. Companies are poised to post about a 4.7% decline year over year according to FactSet Insight. This would mark the first year over year decline since Q’3 2020 while we were in the midst of the pandemic. If that ends up being the trough

that would be palatable , but with negative earnings guidance outnumber positive guidance by a factor of 3:1 it suggests Q’1 numbers coming in April may offer little reason for near term optimism. After possibly “over-earning,” a strange phrase I will admit, profit margins are set to come back down after being as high as 13-14%. If margins can still hold around 12%, that would be a positive sign that labor and commodity prices have not made too much impact, but worth monitoring. It does seem that for the market to take its next leg higher we would need to see either an improvement in earnings or a cut to interest rates. If I was wagering on one versus the other, I am more optimistic that with real growth possibly still in the 2-3% range for Q’1 (see Atlanta Fed GDPNOW forecasts) earnings may be better than forecasted as we muddle through the first half of the year. The market remains fully priced in the aggregate, but not at the elevated valuations we saw at the end of 2021. While equity returns for the next 10 years may trail those of the last 10 years, they are still likely to outpace cash and fixed income by 2-3% in real terms.

Correlations and Diversification

Markets still remain rather correlated something we have been witnessing for the last 15 months or so, a good day for the stock market is a good day for the bond market and vice versa, in the long run that relationship breaks down, those many falsely assume that a good stock market is bad for the bond market. Truth be told, you can experience positive absolute returns in both asset classes fairly regularly, stocks tend to rise about 70% of the time when looked at from an annual perspective and with bonds the likelihood of a positive return is close to 90% annually when looking at the investment grade space. While we welcome the days when both asset classes are driving positive effects to our bottom line, we would prefer to see a more healthy correlation relationship return between the two primary places to invest. There is likely some light at the end of the tunnel once the Fed is done with it’s hiking cycle, though that may take a couple more quarters. In the interim, limiting duration within the fixed income holdings should reduce some of that effect while having more of a quality tilt (style agnostic) would be the equity equivalent. While quality as a factor could lead to lower returns depending on the time in the cycle, they tend to experience less volatility and smaller drawdowns.

Looking Ahead

As for 2023, you have to be pleased with the start to 2023, even while the market is in the midst of a little swoon. Maintaining a somewhat cautious

approach is appropriate until further clarity on the Fed’s glidepath becomes evident. Where risk was skewed to the upside a couple times in the last 6 months (October 2022s lows and again to start the year) when sentiment was bottoming we’ll probably need a bit more to break right (wages and earnings) otherwise you could see risk to the downside elevate. With the S&P up still north of 4% and the Nasdaq up over 10% taking a little profits wouldn’t be the worst thing especially since the market is up about 15% since the October lows and your equity weightings are close to if not a little above their target ranges.

In previous pieces I had highlighted the relative appeal of Treasuries which represent an attractive option for fixed income investors or for folks sitting on idle cash, that likely will be the case for the next 12-18 months. Agency bonds, which carry the same ratings of Treasuries with their implicit government backing are also appealing, with yields about 10-20 bps higher than a comparable Treasury. There are some pockets of value in the stock market as well, where a couple of sectors standout in the US. Healthcare stocks held up well in 2022, comparatively speaking shedding only 2.0% for the year, this year they are the 3rd worst performer down 3.08% versus the market’s 6.24% gain.

That’s a rather wide margin for a sector with both defensive characteristics, while offering the prospect for growth. The other sector that seems to be worth giving a closer look are financials, which offered middle of the pack performance last year (10.5%) and trail the broader average modestly (6.06%) thus far in the new year. The combination of improved net interest margins coupled with an improving market for IPOs and possibly a pickup in housing later this year should serve as tailwinds and enough to offset charge-offs for subprime auto loans and credit cards.

Lastly coming back to the January market update, we discussed the impressive outperformance of overseas stocks versus the US stocks. In the developed world, the ability to avert a recession in Europe along with markedly lower valuations has been supportive of this trade and it may very well have some room to continue given the fiscal and monetary backdrops. Emerging markets have been impacted a bit by some geopolitical questions in places like Brazil, India and Turkey to name a few, but if the dollar continues to fade from the levels touched last Fall that would not hurt stocks here, especially those tied to the consumer. In the coming weeks and months, we look forward to sharing some insights regarding tax season and some planning strategies for 2023, as well as taking why taking wellness seriously outside of your portfolio, is just as important as your market scorecard.

Feel free to share the information with anyone that would find this worthwhile.

The enclosed content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within constitutes a solicitation, recommendation, endorsement, or offer by Breakwater Capital to buy or sell any securities or other financial instruments or offering in this or in in any other jurisdiction. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information contained within before making any decisions based on such information.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2, available upon request or at the SEC’s Investment Adviser Public Disclosure website.

Source: Data/Statistics from FactSet, Bloomberg, JP Morgan Asset Management, Charles Schwab & Co, Barron’s & WSJ

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.