Au Revoir April

As we wind down April and reflexively question whether it best to “sell in May and go away” (the answer is no) I can’t help but think Warren Buffett said it best when he quipped, “ I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner, or later, one will”. While he was referring to picking winners in the stock market, it’s safe to say the same could be said of investing in the United States of America itself, where despite the constant idiocy and self-sabotage emanating from Washington, we keep moving forward. The next few weeks we’ll likely find ourselves drowning in debate over the debt ceiling which distracts from the fact the economy continues to be remarkably resilient even though we have been hearing talks of a recession for the better part of the last 12 months. It may very well be the most widely predicted contraction in history yet the odds of a soft landing are no worse than a coin toss at this point. Surely, there are some signs of slowing in the economy, the combination of a modest uptick in weekly unemployment filings and deterioration in the Conference Board’s Leading Economic Indicators are worth monitoring. But for all the handwringing over the slowdown, the combination decelerating inflation, better-than-expected earnings for the first quarter and an uptick in the Manufacturing PMIs for April versus March’s readings, are a reason to be a bit more balanced in one’s view if not just a little optimistic.

Diving a bit deeper into the earnings picture, according to FactSet’s Earnings Insight, for the week ending April 21st, 76% of the companies reporting have beat earnings estimates and 63% have beat on revenue, granted it was only 90 companies that have reported and this week will better determine whether Q’1 exceeds to the upside as we hear from a number of the tech behemoths (aside from Apple who reports next week). After another impressive quarter from Microsoft (MSFT) and a $70BB buyback from Google parent Alphabet (GOOG) suggest that demand for their services remain robust which is encouraging. There has been a great deal of fuss about margin compression, but margins are likely to remain around 11.2-11.4%, right in line with their 5 year averages suggesting they have been able to offset inflationary headwinds better than mom and pop. This has been especially evident as we have heard from the likes of Procter & Gamble (PG), PepsiCo (PEP) and McDonald’s (MCD) where they have been able to increase their prices while volumes remain flat. Eventually consumers may push back against price hikes, something we are seeing more in Europe. To be clear earnings may be flat to modestly down for the quarter when comparing year to year results, but the early estimates of an 8% decline seems far too pessimistic.

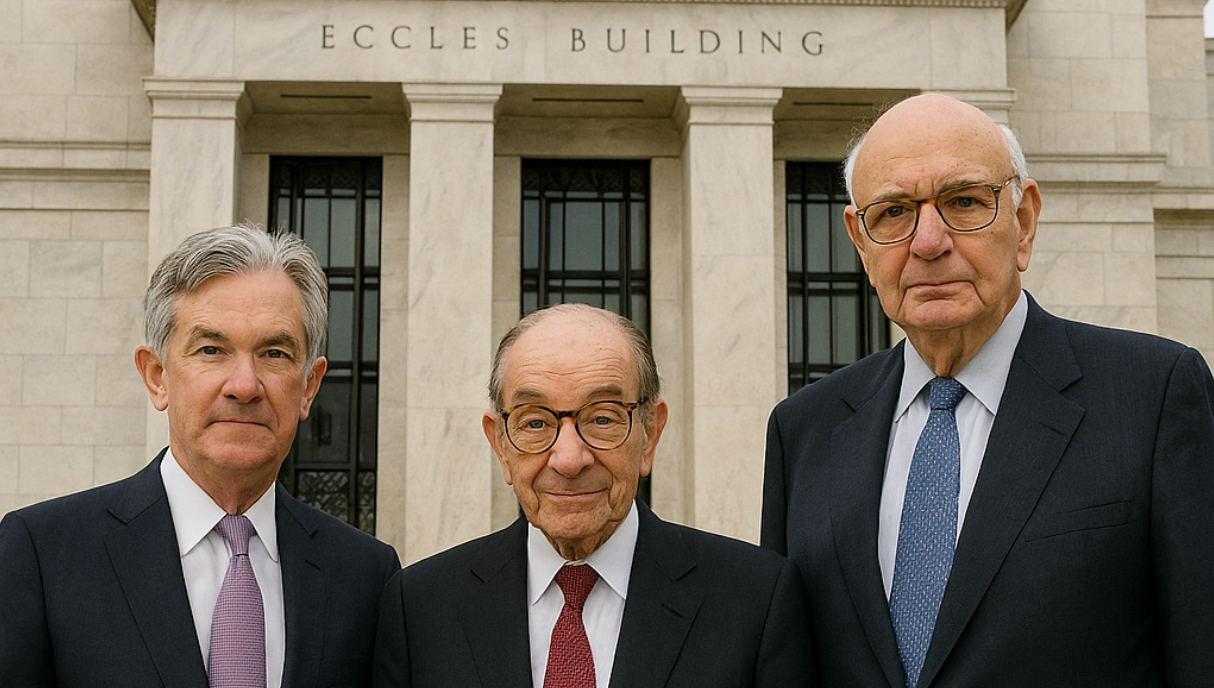

Next week the Fed may very well wind down the most aggressive tightening cycle since the early 1980s, as the with the market is pricing in nearly a 90% chance for them to hike by 25 basis points. This leaves the Fed Fund’s rate in a range of between 5.00-5.25% a level last seen before the Financial Crisis in 2006-2007. The cost of capital has increased markedly in just a year’s time, there will be some companies that will struggle to service their debt or rollover existing issues coming due in the months and years ahead, but higher borrowing costs should lead to more fiscal discipline and perhaps better productivity and ROI. The bond market is signaling it won’t be too long before the Fed is forced to ease, perhaps as soon as their September meeting, but in order for such a quick pivot to occur that would mean we would need to see some real deterioration in the economy as a whole and employment outlook more acutely, which doesn’t seem too obvious at present. In the long run, should the Fed stick to their 2% inflation target, with rates north of 5% policy remains a drag on the economy. If we do see inflation continue to decelerate taking CPI down into the 4s and PCE into the 3s it stands to reason they could take their foot off the brakes starting in early 2024 but unlikely before then. Pardon me if I seem like I am being overly optimistic, we can all use the occasional pep-talk and the bright spot about idiots running great companies, they eventually get fired.

Join us next month as we return our focus to wellness. May will be all about behavioral finance and ways you can improve your process around decision making and filtering. Here’s to May bringing us Spring Flowers…

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.