Understanding Current Market Volatility

Yuck… some of you may feel compelled to swap out the first letter of the word I’ve chosen to describe the month of September, or frankly all of 2022 to this point. If you feel like you just got out of the ring with Muhammad Ali (circa the Sonny Liston days) you are not alone. With a little over three months to go before the calendar flips over, 2022 may very well go down as one of the worst years for the markets going back to the 1930s. Narrowing the field of vision to the start of this century, only 2008, during the Great Financial Crisis when the market declined 37% and 2002, where the aftermath of the bursting of the dot com bubble was compounded by the tragic events of 9/11 leading the S&P 500 to shed 22% then. As of the close of trading on September 23rd, the market is down 21.6%, so just a hair from taking over the number 2 spot, and for many this feels far worse. Whether it’s the fact that diversification this year has provided no real cushion (the bond market is down over 12%, it’s worst year on record) as has been the case in the past, the seemingly endless daily volatility or that many investors were broadly over-exposed to stocks after a long bull market, especially some of the high beta growth stocks that were highfliers in the early days of the pandemic market euphoria, the pain has been acutely felt everywhere. From time to time I’ll informally survey clients to get a pulse on their feelings, I would not be exaggerating when I say that for many this feels like perhaps their worst year in their experience. The breathtaking declines over the 5-week span in February-March of 2020 when the market dived 35% or Black Monday’s 22.6% drop which had been proceeded by a 4.6% drop the Friday prior were so swift that an investor wasn’t even able to formulate a strategy before it was all over. Those two years somehow managed to end the year in the black, very hard to fathom us being so fortunate today.

So what is going on… You can attribute the market weakness to several factors, some of which I’ll expand on below, though in the end much of it boils down to the fact there is a significant amount of short-term uncertainty and a crisis of confidence.

- Higher rates mean lower valuations

- Connally’s famous quote, “the dollar is our currency, but it’s your problem”

- Geopolitical developments, by now we all understand the war in Ukraine has wreaked havoc on European energy markets likely leading to a pretty significant recession on the continent while in the Far East, the Chinese continue to embrace a draconian lockdown policy to limit Covid’s spread. The Iran Nuclear deal, an election in Brazil and the return of Reaganomics in the UK are other notable matters, but this list is hardly exhaustive

- Quantitative tightening accelerates

- The prospect of an imminent earnings decline meaning current estimates are too high thus a further correction may be needed to support valuations

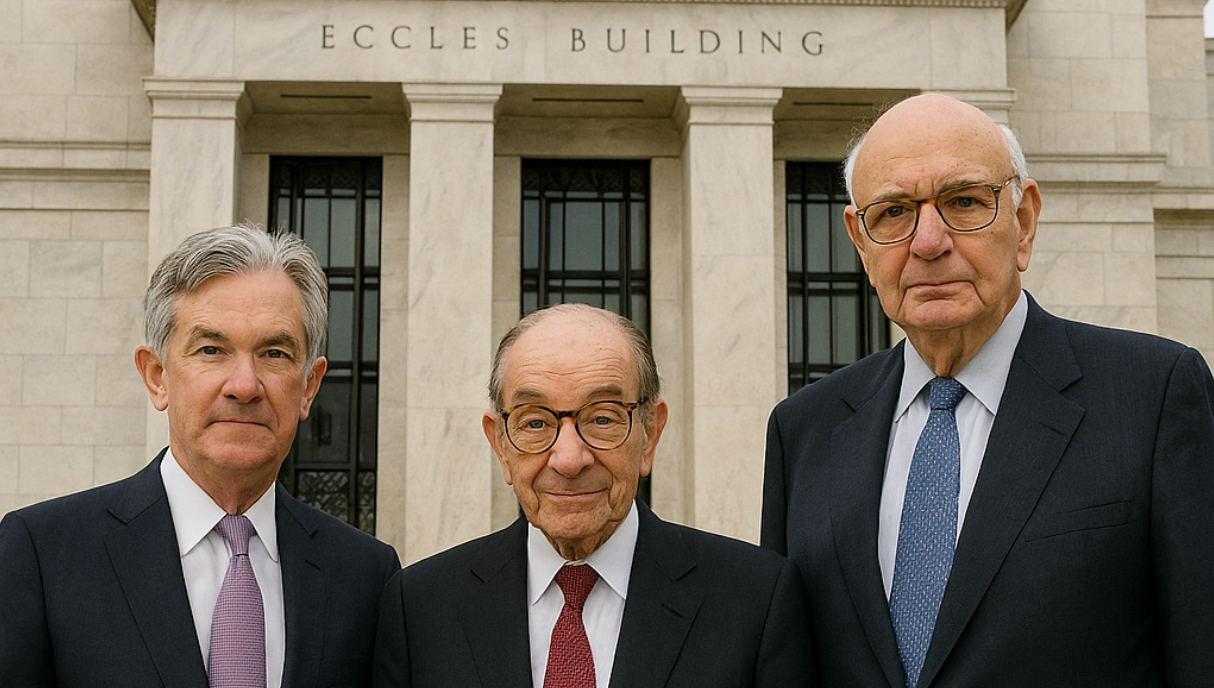

Rather than unpack each of the points and sure you could probably throw others into the fold (domestic policy/politics to name one) I’ll address a few of them in depth and spare you where I think your exposure to the subject matter has more than reached its saturation point. Here is an anecdote along those lines. In speaking with my father this past week, and I am paraphrasing here, but he referenced how the Fed’s announcement and Powell’s presser represented somewhat of a must-see television event. Keep in mind that while my father is a worldly character and astute investor, our conversations rarely wander into the topic of interest rate policy. In reflecting on that comment, I found myself somewhat alarmed by the fact that there is far too much focus on short term headlines many of which are only modestly relevant to one’s long-term investment objectives. When we find ourselves obsessing over every detail of a single data point, at a point in time, we are bound to lose sight of the bigger picture, hopefully this note helps with re-anchoring our investment expectations as we persevere through this rough patch.

1. Valuations & Earnings: Stocks have rerated from a multiple of 21 when we entered the year to about 15.5 according to current FactSet estimates, with this being the result of a collapse in P(rice) while E(arnings) have held up. Chalk up the latter to a resilient consumer and nimble and efficient corporations , the question of how sustainable this phenomenon is we’ll return to in a moment. When real interest rates were negative you could essentially pay anything for a company and end up ahead, so long as they had some earnings, which is perplexing why stocks that have yet to actual earn anything or will ever in the future commanded such high prices, but now with real yields positive and mid-single digit returns available in the investment grade debt market nosebleed valuations cannot be justified. There is a simple formula to arrive at the P/E for the market, yes it’s an oversimplification but helpful nonetheless. When taking the number 20, and subtracting the rate of inflation you could arrive at a reasonable P/E for stocks. Using the Fed’s 2% target meant 18X was not out of the question, even if it was higher than the long run average of 16X over the last 100 years or so. With inflation now at 8.3% according to CPI that would mean the market should be trading at less than 12X or about 20% less than it is today. I am not predicting that type of further rerating just sharing one perspective. Assuming inflation starts to trend back down to the 3-4% territory over the next 12-18 months, you are still looking at equities that are around fair value versus a screaming buy, which is where we were after the most recent large sell offs in 2020 and Q’4 2018. That math assumes earnings hold up, if not even grow modestly over the next few quarters (the consensus is still calling for 3.2% growth in Q’3 earnings which we’ll start to hear in another 2-3 weeks.) The issue is that if earnings deteriorate, prices have further to fall. With the Fed calling for an unemployment rate to rise to 4.4% in 2023 & 2024 (I would describe this optimistic view as a soft landing) we are taking about 1.4MM Americans losing their jobs not to mention the limited spending power of our allies in Europe or in other parts of the globe. If earnings decline by 10%, then we are probably okay here, but if earnings follow their typical path in a recession and drop by around 25-30% it stands to reason that prices would need to go lower to support this multiple. This is why you have seen a number of the big Wall Street firms lowering their year end estimates for the S&P, for example David Kostin at Goldman clipped their figure to 3600 earlier this week.

Below is the link to Factset’s piece from yesterday which is chockfull of insightful data on earnings

2. If you converted your dollars to pound sterling right now, you’d actually feel a little wealthier than you did when opining about your New Year’s resolution back in January. There has been an important development that has not received nearly as much attention as warranted, the meteoric rise of the dollar against much of the currency complex. We have seen dollar Euro parity recently, it’s now below the dollar. The UK’s pound sterling is all the way down to $1.04 versus the dollar, I recall when the exchange rate was over $2.00 prior to the GFC and the Japanese Yen is back to levels last seen in the midst of the “Asian Flu” in 1998. Why is this important? Primarily it can exacerbate inflation abroad given that many commodities are dominated in dollars thus adversely affecting countries already impacted by supply chain issues, an energy embargo or the limited access to supply due to geography or as a result of the underinvestment in natural resources over the last decade. Another issue here is due to the fact the dollar is the reserve currency and thus plays significant role in the funding/credit markets. Given the propensity for countries looking to issue greenback denominated debt where interest rates are often much lower than local rates, this could really become a problem over the next 2-3 years as new issuance or refinancing becomes necessary. An alternative view is that perhaps this is a coordinated policy intervention, something of a reverse Plaza Accord when the dollar was devalued back in the mid 1980s. This time the shoe is on the other foot where the weakening of currencies from a number of export driven economies may bolster their competitiveness and jump start their growth, it’s just unlikely to have much of an effect when global growth is declining and a recession seems likely if not inevitable. Maybe this does pay off down the line. There is also the possibility that the Fed’s hawkish stance to slay inflation is providing cover for the central banks across the world that had been using negative interest rates policy to get back into positive territory nominally at least. Clearly ultra-cheap money abroad did not lead to higher growth rates, in some reverse logic maybe higher rates will create a sense of urgency and provide a healthier level of inflation after we get through this current bout.

3. Since last November when the real “Powell Pivot” occurred and comments from the Fed became more hawkish with the forthcoming end to quantitative easing and set the table for raising rates, markets have pricing in higher yields on the short end and we did see some effect on the long end too. Recall the 10-year Treasury started the year at about 1.50% and closed Friday at 3.70% up 220 basis points, a sizable move though not quite historic in an absolute sense. But longer-term rates had stalled out in June until this week’s spike higher. The prior narrative had been that short term rates best express the Fed’s hawkish current policy, if they continued on the current trajectory they were bound to break things leading to a recession and thus slower growth and lower inflation in the future. If that were to be the case then a lower yielding long bond seemed perfectly plausible. Recall that inflation for the 10 years prior to the pandemic averaged just short of 2%, add a little term premium for the duration and you get to a yield between 3-3.50% very much in line with the rangebound trading the last few months. But now with the long end moving higher, is the belief that in fact growth may be a little north of the long run trend given the economic resiliency here in the States ? Or more likely have the bond vigilantes finally taken their shot at the market with a buyers strike right when quantitative tightening ratcheted up this month. With the Fed allowing even more securities to roll off their $9TT balance sheet, a big buyer has stepped away thus sapping about $95BB worth of demand out of the market, $60BB of Treasuries and $35BB of MBS. If stocks were going to struggle to justify valuations with earnings fading, contending with higher rates then becomes further weight to the tape. Just as I am reluctant to attempt to predict the short term direction of the stock market I am going to refrain from sticking my neck out here as well.

So what is an investor to do…

- Stick with your asset allocation strategy, if at the margin you want to make adjustments that’s fine but don’t get caught trying to market time. You’ve already taken a good punch, in theory the time to sell was back at the all-time high in January.

- For those of you willing to be a bit more opportunistic market dislocations can create opportunities, perhaps you have some money sitting on the sidelines with the intention of investing , it may not be a bad time to put to work slowly, perhaps using a dollar cost averaging approach for the next 3-6 months. With the VIX just shy of 30 there is some palpable fear our there which usually means the market is a bit oversold and bargains can be had.

- We all have some cash sitting around likely getting hardly any interest, you can buy 6-month Treasury bills yielding not too far from 4% (3.86% at Friday’s close.) If you don’t mind extending duration, laddering out 6, 12, 18 & 24 month investments likely gets you to 4% on average and if rates do start to go back down in late 2023 or early 2024 you’ll feel a little better having locked in those higher rates for a little longer. If rates keep going up that’s just fine, you’ll have money available to reinvest as the short-term maturities in your ladder come due. Keep in mind for those of high-income tax states Treasuries are exempt from state taxes. There are also some attractive blue chip companies with yields between 4.50-5.00% going out anywhere from 1-3 years and offering a little more if you extend duration 4-6 years out and municipal bonds are starting to look cheap interesting too.

- Consider a Roth conversion, with asset prices depressed you are able to convert roughly 125% of the amount of shares you would have back in January, I understand the idea of paying more in taxes may feel like adding insult to injury, but this is likely to pay off if you have a holding period of 10 years or more for the Roth

- Rather than wait to fund your Health Savings account or Roth IRA for 2022 up until April 2023 now may be a good time to make those contributions

- Harvest tax losses wherever possible, given the market volatility and investor outflows many mutual funds will likely make sizable distributions in the 4th quarter despite the fact the fund lost money this year, this phenomenon is the result of fund managers needing to sell securities to cover client redemptions resulting in the fund realizing gains that had actually occurred over the last 10+ years

Remember markets are discounting systems, they will turn far earlier than the actual economic data seems to suggest. Legendary investor George Soros has talked about the concept of reflexivity and this theory seems rather evident today where price action is having as much influence on markets or economy than the other way around. Quoting Soros, “I can state the core idea in two relatively simple propositions. One is that in situations that have thinking participants, the participants’ view of the world is always partial and distorted. That is the principle of fallibility. The other is that these distorted views can influence the situation to which they relate because false views lead to inappropriate actions. That is the principle of reflexivity.” Perhaps more simply stated markets tend to be dislocated from the equilibrium that defines efficient markets more often than not. This is the result of human beings’ tendency to overshoot assuming that the good days will never end or alternatively that this is the crisis to end all crises and that the sky is truly falling. It’s hard to quantify how much of the selling is a result of the selling and lower prices that have already occurred. It’s not until investors have exhausted themselves with the selling (or buying when exuberance sets in) that markets can drift back towards their real fair value. Along those same lines Nobel Prize winning behavioral economist Richard Thaler has written about the irrationality of the human actors that are everyday market participants in two of his great books “Nudge” and “Misbehaving”. His reasoning is that if the planet were filled with emotionless characters like Star Trek’s Mr. Spock, referred to as “Econs” , markets would likely oscillate a lot less than they do. That seems wonderful right about now, but you’d likely have to forgo the equity risk premium and sacrifice some of that excess return. Stay patient and humble and you’ll be okay in the long run. It’s hardly a perfect system, but it has its advantages and surely better than the alternative systems in place.

Thank you for letting me occupy some of your valuable time!

Feel free to share the information with anyone that would find this worthwhile. If you would prefer to be removed from the distribution list, please send a reply email to this message and you’ll cease receiving content.

The enclosed content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within constitutes a solicitation, recommendation, endorsement, or offer by Breakwater Capital to buy or sell any securities or other financial instruments or offering in this or in in any other jurisdiction. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information contained within before making any decisions based on such information.

Source: Data/Statistics from Factset, Bloomberg, JP Morgan Asset Management

Breakwater Team

At Breakwater Capital, we work with families across the United States, providing each client with a personalized experience tailored to their current circumstances, future goals, and timelines.